Forget autonomous vehicles; the impact of these trends is being felt today, says Scot Eisenfelder.

Affinitiv CEO Scot Eisenfelder is shining a spotlight on five industry trends that have the potential to negatively impact auto dealership operations in 2019, unless dealers take immediate action. Although disruptors such as autonomous vehicles, ride sharing and alternative powertrain vehicles dominate today’s headlines, these trends are several years away from having a direct impact on dealership operations.

Five trends that Eisenfelder has identified as having more immediate impact include declining front-end margins, improved product quality, more onboard technology, aging units-in-operation (UIO) and consumer expectations.

“While the news is full of major disruptors, there are more practical realities shaping auto retail today,” said Eisenfelder. “Virtually all of these trends will force dealerships to rely more on fixed ops as a source of future profit.”

1. Declining Front-End Margins

New vehicle gross margins have declined significantly in the last seven years, from 4.0 percent in 2011 to 2.2 percent in 2018. The same pricing transparency that drove down new-vehicle per vehicle retail (PVR) is likely to drive down F&I PVR in the next few years.

To combat this trend, dealers will be forced to shift their business strategy to a razor and razor-blade model, whereby products are sold cheaply and all the profit is made on the back end.

“This requires a shift in operational mindset,” said Eisenfelder. “If you can’t make a killing off the first sale, how do you manage the customer relationship going forward?”

Dealers should invest in service marketing designed to increase customer loyalty, and in technologies designed to improve the customer experience in the service department.

2. Improved Product Quality

Available work per unit is declining as quality improves, service intervals lengthen and work shifts from repair to replace.

“Dealers can no longer count on substantial warranty work and in-warranty customer pay business from new vehicle sales as a way to feed steady business to their service departments,” said Eisenfelder. “Additionally, the average service interval length has increased from every 3,000 miles years ago, to nearly 10,000 miles today.”

To address this, dealers need to maximize Revenue per Units-in-Operation ($/UIO). Today’s franchise dealers only capture 20 to 25 percent of revenue potential from their UIO, and less than half the work needed on vehicles that enter their service lanes. To increase service yield, dealers should focus on providing complete vehicle care to current customers.

This requires the ability to identify, communicate and capture all service needs, which may require modernizations to the write-up, multi-point inspection (MPI) and service recommendation processes.

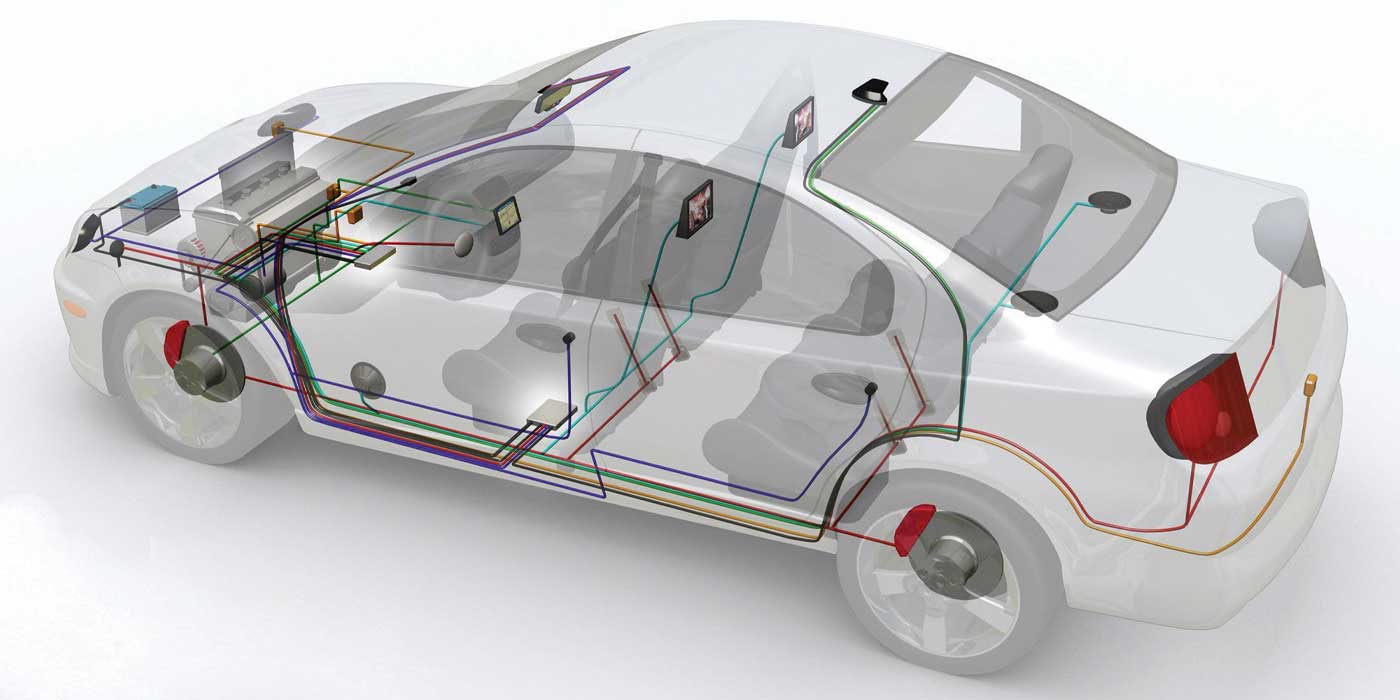

3. More Onboard Technology

This trend favors dealerships, giving them a competitive advantage over independent repair facilities (IRF) based on technician knowledge. To leverage this advantage, dealers need to move beyond an oil change mentality and send relevant, targeted offers based on customer data, vehicle mileage and service history. This requires the ability to leverage data contained in the DMS/CRM.

4. Aging UIO

Most industry analysts predict a flat to declining new vehicle market through 2021. This means fewer one- to three- year old vehicles to service, with a corresponding increase in four- to six-year-old vehicles.

Number of Units-in-Operation Change Since 2017*

| Vehicle Age | 2018 | 2019 | 2020 | 2021 |

| 10-12 Years | -8% | -20% | -29% | -30% |

| 7-9 Years | -9% | -5% | 2% | 18% |

| 4-6 Years | 16% | 30% | 38% | 37% |

| 1-3 Years | -1% | -5% | -7% | -7% |

*Automotive News: Scrappage not removed; assumes 2018-2020 sales of 305K units.

“In this environment, sales conquest becomes brutally competitive and essentially a zero-sum game,” said Eisenfelder. “In fact, it’s pretty common to see incremental marketing costs exceed gross margin net of commissions.”

Additionally, dealers are facing increased competition from IRFs that have seen a decrease in seven- to 10-year-old vehicles to service, which are their traditional bread and butter. As a result, IRFs are aggressively targeting the four- to six- year old market.

To combat this trend, dealers will need to shift marketing spend into service conquest, which delivers better ROI at an average $40 to $80 per customer acquisition, compared to the average $1,200 to $1,600 per customer acquisition in sales. Conquest efforts should focus on finding and servicing second owners of four- to six-year-old vehicles. Dealers also need to do better at retaining current customers through post warranty.

5. Consumer Expectations

Today’s consumers expect a transparent, modern and convenience-driven experience, which traditional dealer processes and systems are ill-equipped to deliver.

“It’s truly baffling because a person can track a pizza being made and delivered to them, but they must call your dealership several times to check on the status of their car, then wait in line to pay at a cashier,” said Eisenfelder.

Dealers need to improve service pricing transparency and invest in technologies and amenities that modernize the customer experience.

Links:

Affinitiv