Dealers Partner with Third-Party Platforms to Defend Their Turf from New Online Competitors

It’s no secret that customers don’t love car buying. Most consumers would rather go to the dentist, do their taxes or sit in a middle seat, than go shopping for a car. According to Autotrader, less than 1% of consumers like the current car-buying process. Additionally, one in six new buyers did not buy from the first dealership they visited because they had a poor sales experience.

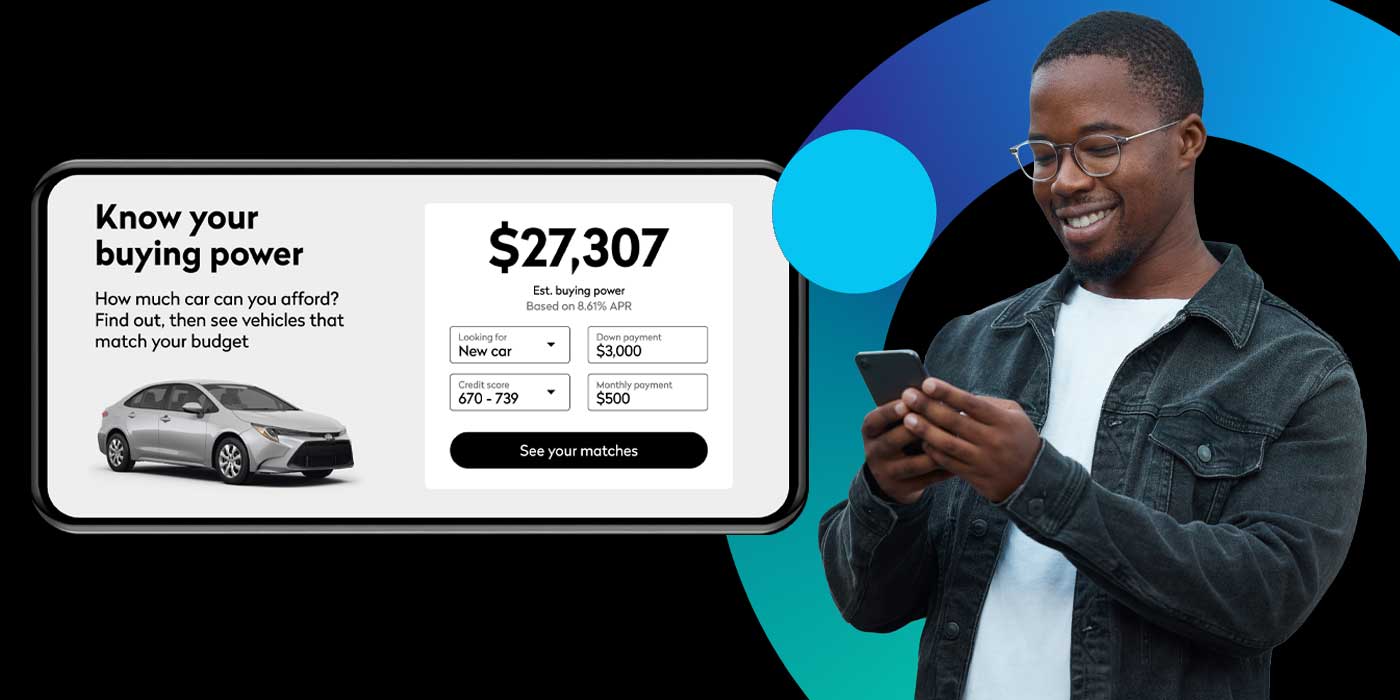

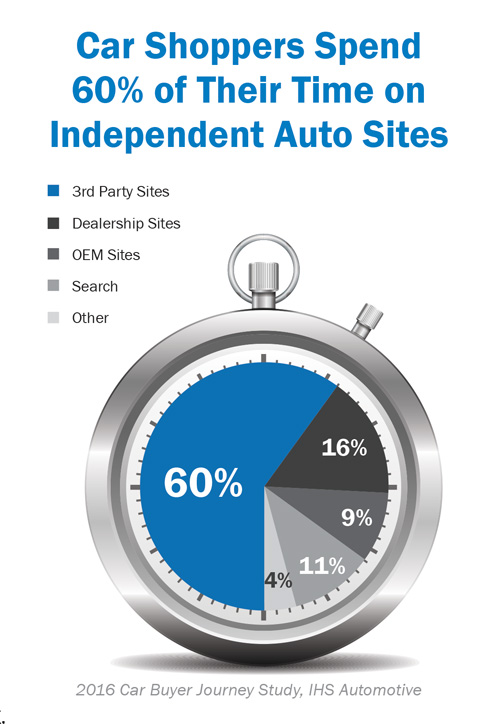

Consequently, customers are demanding dramatic changes to the car shopping experience and they are voting with their wallets. They don’t like to negotiate, and they don’t like to spend a lot of time at the dealership, so 9 out of 10 consumers have migrated to the internet to save time and to avoid the friction. According to the Digital Influence in Automotive Report by CNR Research, consumers spend the vast majority of their time on third-party sites (60%). Customers find these third-party sites to be easier for shopping all makes and they perceive they are more credible due to their independence and lack of affiliation with one brand or dealership.

As a result, third-party sites are growing in their influence on consumers, so dealers need to be aware of how to leverage these sites to complement what they’re doing with their own website and direct marketing efforts. The most successful dealers recognize this shift in consumer behavior, so they are improving their technology and processes to meet the rising expectations of their customers, and they are partnering with the right third-party players who are friendly to dealers.

Digital Influence in Automotive Report by CNR Research

Today there are more third-party sites than ever before, some who are dealer friendly and others who compete with dealers. Some third-party platforms connect consumers with dealers who sell the car, but a few new players are trying to disenfranchise dealers altogether. Amongst the players who connect consumers with dealers, there are many types; some have created a pricing marketplace where dealers are compared solely on price, others send consumer data to multiple dealers who email the customer multiple prices, while others connect one customer to one dealer who provides a fair, upfront price that doesn’t require the customer to negotiate.

The platforms that pit the dealers against each other solely on price have taken a lot of flak for creating what dealers call “a race to the bottom.” The platforms that send the same lead to up to 20 dealers are upsetting consumers because people don’t want 20 or more dealers contacting them at once, and dealers don’t like it either, because this approach hurts their conversion rate, average profit and customer satisfaction.

However, the players that are causing the most concern for dealers and dealer associations are the platforms that are competing directly and using their big ad dollars to paint dealers in a bad light. Dealers are up in arms about the third parties who have big ad campaigns that are stoking consumers’ fears about car dealers by promoting negative images of stereotypical “wheeler-dealers,” with the hope to scare consumers away from dealers and onto their websites.

Carvana, one of the newest online car-buying platforms, is a public company valued at more than $10 billion, which means they have the capacity to spend hundreds of millions of dollars in marketing, which is impossible for a local dealer to compete with.

“There are a lot of companies out there spending millions of dollars convincing customers not to work with us,” said Brian Benstock, VP of Paragon Auto Group in Queens, NY. “Although our website is great, we know we need to work with third-party sites, so we are working with the right ones, the ones who help us sell cars. Autotrader and Cars.com work well for used cars and Fair and CarSaver convert the highest.”

Most of the largest dealers are leveraging a few dealer-friendly third-party providers to help them compete against formidable competitors like Carvana, Vroom and others that have big ad budgets promoting their national brands. Some of the third-parties that dealers are working with include AutoTrader and Cars.com, who have been dealer-centric classified sites for over 20 years, and some newcomers including Walmart and Fair, are helping local dealers compete head on against their well-heeled online competitors. CarSaver at Walmart is a new and used vehicle platform that gives dealers the promotional backing of the biggest retailer in the world, and Fair, founded by Scott Painter (formerly of TrueCar) and Georg Bauer, is a used car leasing platform.

CarSaver at Walmart, another dealer-friendly platform, recently launched an auto program for dealers that helps them sell cars to Walmart’s 250 million customers and 1.5 million employees. Walmart’s customers and employees get everyday low prices from CarSaver’s network of certified dealers who agree to provide up-front pricing, set by the dealer, and express service to Walmart’s customers. In exchange, participating dealers and their inventory are promoted on Walmart.com, the fourth largest search engine in the U.S. with over 100 million unique visitors per month, and the program is promoted in Walmart superstores across the country, where more than 140 million consumers visit each week. CarSaver certified dealers get exclusive access to help Walmart’s 1.5 million U.S. employees buy cars through the CarSaver employee purchase program and they receive point-of-purchase merchandising materials that highlight their endorsement from CarSaver at Walmart.

“We’re constantly looking for innovative services that help us save busy families money and time,” said Daniel Eckert, senior vice president, Walmart Services and Digital Acceleration. “CarSaver’s unique platform helps our customers understand the true cost of ownership, while also helping them save money with buying, financing, leasing and insuring a new or used vehicle.”

After the retail giant piloted the program successfully in multiple markets with dealers, including AutoNation, the No. 1 selling dealer group in the U.S., CarSaver at Walmart is bringing on dealers across the country to service their customers nationwide. AutoNation’s Marc Cannon said the program offers the right balance for the dealer and the consumer; “I think it’s going to be successful, and we’re ready to get going.”

“We have seen huge growth in sales as a result of our partnership with CarSaver; last month we were 12th in the nation for GMC sales thanks to the program,” said Brad Hornung from Ferguson Buick GMC in Norman, OK.

To build the dealer network fast, CarSaver offers an “all you can sell” model that delivers unlimited impressions on CarSaver at Walmart.com, unlimited leads, appointments and sales in exchange for a small, flat monthly subscription fee. CarSaver is accepting applications for interested dealers at CarSaverDealers.com. Where the company is oversubscribed, the company said there is a waiting list that is prioritized on a first-come, first-serve basis.

Fair offers short-term used-car leasing payments on participating dealers’ inventory, with a completely digital checkout process and an express delivery at the dealership that owns the car they select. Fair offers very flexible terms, allowing their customers to keep the vehicle as long as they want. Customers receive a limited warranty, routine maintenance and roadside assistance standard.

The process begins with the consumer browsing vehicles from their dealer partner’s inventory, which is organized by monthly payment. When the customer leases the car, Fair purchases the car from the dealership, at a pre-determined wholesale price, which is set by the dealer but adheres to Fair’s pricing parameters. Once the transaction is complete, the dealer is paid for the car along with an additional delivery fee, to bring the car to the customer or they can pick it up at the dealership. Fair customers can return the car any time after providing five days’ notice. The selling dealer gets the first shot at buying the returned vehicle but if they don’t want it, Fair sells it elsewhere.

“Fair is about partnering with the dealers for the benefit of the consumer,” said Georg Bauer, co-founder and president of Fair.com. “The dealers get free customers from Fair and we contribute to happier customers because they don’t spend hours anymore in the dealership being bombarded with paperwork,” added Bauer in an interview with Auto Remarketing. “For Scott and myself, out of the gate, the starting commitment was to say this is partnering with dealers and benefitting the consumer.” There is no cost for a dealer to add their inventory onto the Fair platform. The company makes their money like a bank, building a leasing portfolio of loans that include a margin for the company.

According to the 2016 IHS Automotive Car Buyer Journey Study, “Shoppers find independent research sites to be among the most trustworthy of all sources, second only to their own previous experience with a vehicle and even more trustworthy than friends and family.” The study showed that online shoppers primarily rely on independent research sites, where they spend 60% of their time, dealer websites, where they spend 16% of their time, followed by manufacturer websites, where they spend 9% of their time.

Both CarSaver at Walmart and Fair aim to be dealer friendly, connecting customers directly with the dealer, to test drive or pick up their car. One part of these platforms that is different from other third-party providers is that they deliver sales and they send each customer to only one dealership, not 20, so customers have a better experience and dealers have a higher conversion rate and CSI.

These new dealer-friendly platforms come at an opportune time for dealers who are struggling to compete with some of the new online retailers who are aiming to put them out of business. Third-party sites like Carvana are flush with cash and are outspending local dealers to sell an increasing share of the shrinking market. Dealers who are looking for ways to protect their turf have found an unexpected partner in these two newcomers, CarSaver at Walmart and Fair.

The most successful dealers are working with the right national third-party platforms while also building their local brand and improving their online purchase experience, so more customers choose to buy direct through them down the road.