Best Practices from the Leading Digital Retailers

CUSTOMERS HAVE MIGRATED ONLINE

From groceries to home cleaning supplies, consumers are accustomed to using the web to get everything they need without leaving their homes. While e-commerce has become the norm for all manner of goods, the vast majority of auto sales still require a visit to the dealership, where consumers spend an average of 5.5 hours to complete the transaction, despite spending weeks researching online. Ninety-five percent of consumers start shopping online and 87% prefer to finish there, without visiting a dealership, yet only 1% of car buyers are currently buying that way — far below other retail sectors that average above 20%.

The majority of car companies and dealers use the web solely to drive consumers to showrooms, while well-funded newcomers are using the web as a tool to drive sales online. Digital disrupters like Tesla, Carvana and Vroom have positioned themselves to meet the growing demand that traditional car companies and dealers haven’t met thus far, and they’re capturing significant market share as a result. Now is the time to completely rethink and reinvent retail. The stakes are high, because online sales are spiking to unprecedented levels, so sellers must follow or be left behind, and whoever acts fast could enjoy a significant advantage for years to come.

In this article, we will explore how the most innovative companies are driving the digital transformation of the automotive industry. Tesla, an electric car company, sells new cars direct to consumers online; Nissan is the first traditional car company to offer Buy@Home for both new and used Nissans; Carvana and Vroom sell multiple brands of used cars direct to consumers; and CarSaver @ Walmart sells both new and used cars through a network of dealers across all top brands. Below are more details about each of these companies and their unique approach to digital retailing.

The auto industry has a long history of maverick companies and CEOs challenging the status quo by offering a better way to build and sell cars. Today, that maverick is Elon Musk, founder of Tesla.

Tesla became public in June 2010 and is traded on the NASDAQ under the ticker symbol TSLA. As of Dec. 8, 2021, Tesla had a market cap of $1.05 trillion, larger than GM, Ford, Toyota, Honda and Nissan combined.

The reason lies in Tesla’s sole focus on electric vehicles, world-class design and their use of digital retail to acquire and retain customers who prefer to transact entirely over the web. In doing so, Tesla has pushed other manufacturers and retailers to explore ways to expand their own online efforts.

Nissan, the second largest manufacturer of electric cars, is the first traditional OEM to offer online car buying to their customers. Nissan’s Buy@Home makes it easy for consumers to build their dream car on NissanUSA.com, locate the vehicle in dealer inventory and have it delivered to their front door. “The ease of using Buy@Home, being able to choose your own payments, run your own credit score, appraise your own trade-in, all in real-time, and all with live transactional data and incentives, is what sets the platform apart,” said Eric Frehsee, president, Tamaroff Nissan and Jeffrey Nissan.

Nissan’s Buy@Home also gives customers a personalized virtual garage, providing easy access to their profile, vehicles, pricing, incentives, financing and guaranteed trade values, from any national or local site, with one single login. Nissan licenses CarSaver’s digital retail platform to power Buy@Home and leverage their vast dealer network to deliver and service purchased vehicles. Nissan is the first traditional OEM to future-proof their dealer network, and they plan to launch a new ad campaign to promote the new way to buy a Nissan.

Carvana sells used cars online, and their inventory is available to deliver anywhere in the country. After customers select a car, they’re presented with price, tax, license, fees, payments, terms of the loan, interest rate, down payment and trade-in value transparently disclosed upfront.

Customers can choose to have the vehicle delivered to their homes or to one of the company’s 24 delivery kiosks. Carvana also provides a 90-day warranty and a seven-day test drive, with the option to return the car by the end of the first week if the customer isn’t satisfied.

Carvana became public in April 2017 and is traded on the NYSE under the ticker symbol CVNA. As of Dec. 8, 2021, Carvana had a market cap of $46.07 billion.

Vroom is another online used car dealer that allows consumers to finish the entire car-buying transaction online. The company offers financing and delivers cars to customers nationwide. Vroom also provides a seven-day, money-back guarantee and a 90-day bumper-to-bumper warranty.

“Our goal is to make buying through Vroom as easy as ordering a pizza,” says Vroom Chief Conversion and Product Officer John Caine. “Consumers are becoming so comfortable buying online and that has extended to autos and real estate.”

Vroom completed a successful IPO in June and a follow-on offering in September and is traded on the NASDAQ under the ticker symbol VRM. As of Dec. 8, 2021, Vroom had a market cap of $1.91 billion.

Carvana and Vroom offer multiple brands you can buy online, but they do not offer new cars. CarSaver built the industry’s first online marketplace where consumers can buy and sell all the top brands of new and used cars, 100% online, helping buyers and sellers save time and money by automating the entire process, from first click to home delivery.

CarSaver makes it easy for consumers to do everything online; buy, finance, lease, insure, repair, upgrade and sell, all the top brands of new and used vehicles, through their network of certified dealers who provide local test drives, vehicle delivery and service. Recognized as the 2021 Automotive News PACE Award winner, CarSaver’s online marketplace aggregates hundreds of suppliers and automates thousands of functions, to deliver a simple and seamless experience that is personalized to each shopper.

CarSaver’s marketplace currently supports multiple facets of the industry, from car companies, dealers and trusted brands, like Nissan, Nissan EV, Walmart, SHOP.COM and iHeartMedia, to help their customers save time and money when buying new and used cars online.

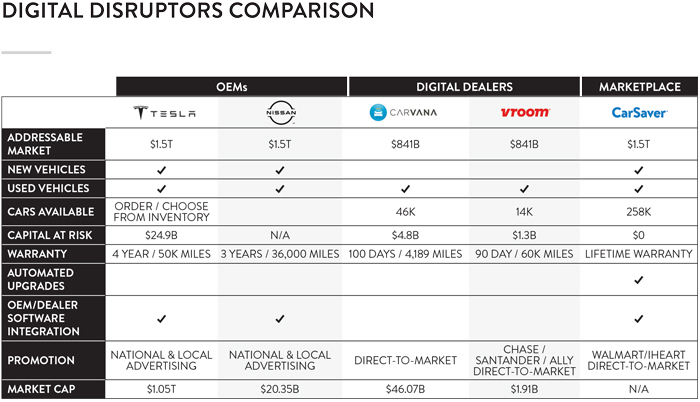

As car buyers migrate online, sellers must act fast or be left behind. Below is comparison of the top players who are leading the digital transformation of the automotive industry.