Dealers deliver contactless commerce to sell more cars

DIGITAL RETAIL TRANSFORMATION

In less than 60 days—not 60 weeks, much less 60 months—massive and unprecedented changes have been thrust upon the industry, and our organizational ability to react has become, quite literally, existential.

While e-commerce has become the norm for all manner of goods—books, travel, groceries, electronics—auto sales have lagged behind, still requiring a visit to the dealership to complete the transaction. Customers have few options for buying cars online, among them Carvana and Vroom, sellers of used cars, Tesla and CarSaver at Walmart, who sell both new and used cars.

While the majority of car companies and dealers use the web solely as a tool to drive consumers to showrooms, these well-funded newcomers are using the web as a tool to drive sales online. With consumers forced into their homes by the coronavirus pandemic, online sales have spiked to unprecedented levels and these well-funded digital disruptors are poised to take a sizable bite out of the market.

Mike Jackson, AutoNation’s CEO, said online sales continue increasing even after stay-at-home restrictions were eased. “This is what the industry has needed to do for a long time,” he said. “This is an inflection point, a strategic shift, and it’s not going back.”

In this article, we share best practices of the biggest and best players online, along with the technology they use to deliver a seamless online experience at scale. We explore what online buyers expect, who is meeting those expectations, where the industry is falling short, and how you can fill the gap.

ONLINE BUYER PREFERENCES

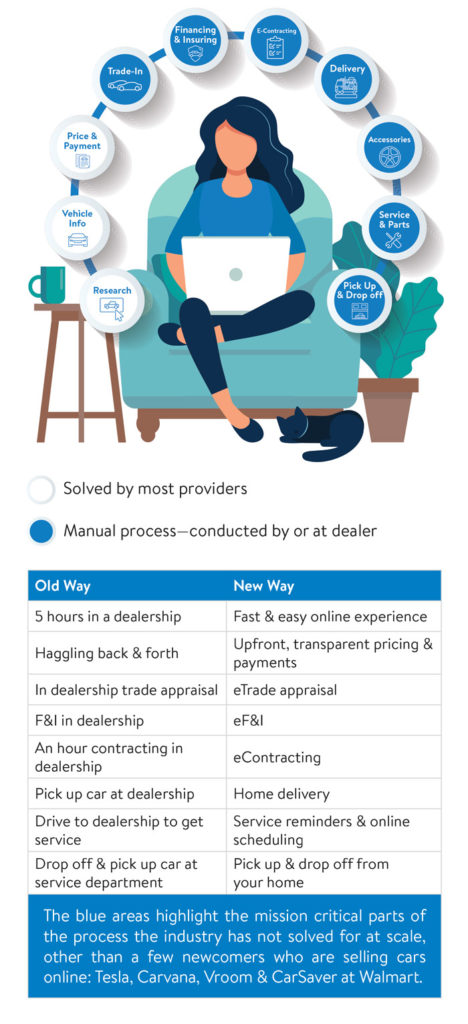

The most successful companies deliver a world-class customer experience by removing all the friction for consumers. This begins with replacing the hassle of haggling with transparent and upfront pricing; creating a fast and easy online buying experience; and saving consumers hours of waiting at the dealership with home delivery. But that’s easier said than done. Most industry players aren’t equipped with the people, processes or technology to deliver a frictionless experience that doesn’t require a visit to the dealership.

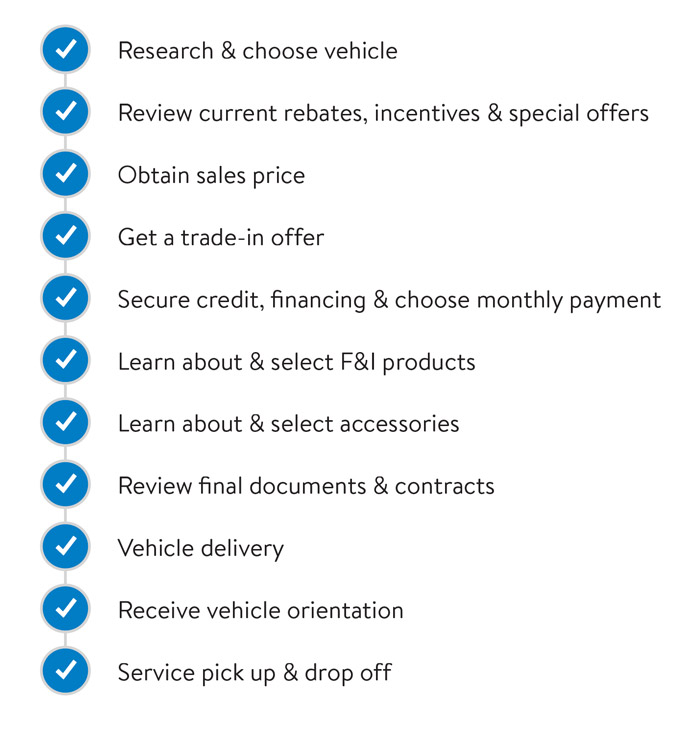

Below is a summary of what customers say they want when buying a car online.

ONLINE BUYER’S JOURNEY

Below is a summary of the online buyer’s journey with the most challenging areas for OEMs and dealers highlighted in blue.

DIGITAL DISRUPTORS

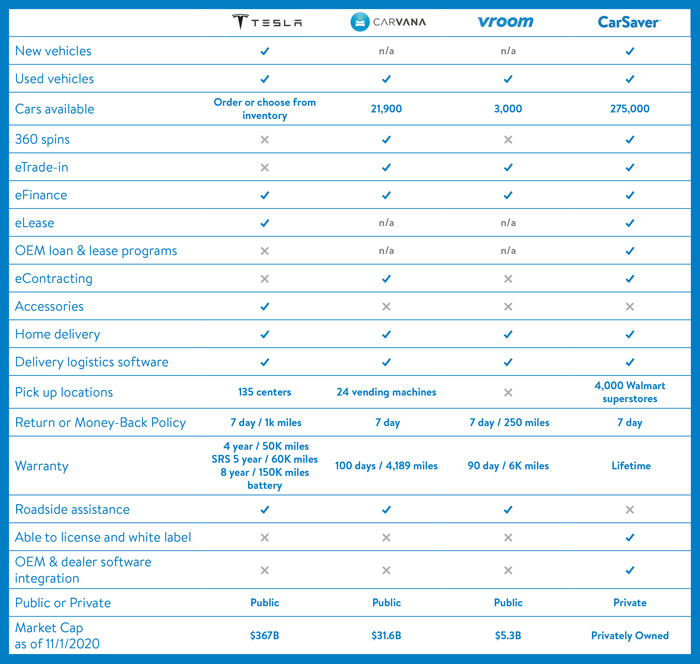

Digital disruptors like Tesla, Carvana, Vroom and Walmart have positioned themselves to meet the growing demand from online car buyers that traditional car companies and dealers haven’t met. Tesla sells new and used cars direct to consumers; Carvana and Vroom sell used cars direct to consumers; and Walmart sells both new and used cars through a network of dealers that represent all top brands.

Some of these companies are public and have enough capital to significantly disrupt the industry. Carvana is currently valued above $31 billion and Tesla at $367 billion, partly because the market perceives they’re positioned to win in the new digital economy.

All these newcomers compete directly with traditional car companies and dealers, except Walmart, who chose to partner with the industry to help their 250 million customers buy online.

WALMART PARTNERS WITH DEALERS TO SELL CARS

While the other newcomers compete directly with traditional car companies and dealers, Walmart chose to partner with them, to offer all top brands of new and pre-owned vehicles through a network of franchised dealers who have committed to provide fair pricing and the highest level of customer service to Walmart’s customers. The program comes at an opportune time for dealers, who are struggling to compete with well-funded online retailers aiming to replace them altogether.

Walmart is currently rolling out a national online auto buying platform, CarSaver at Walmart, to help their 250 million customers save time and money when they buy, finance, lease and insure all brands of new and used cars. Similar to the others, consumers can do everything online, have the vehicle delivered to their door, and it comes with a lifetime warranty.

Dealers looking for ways to protect their turf have found an unexpected friend in Walmart, who is providing unprecedented access to hundreds of millions of customers, at a fraction of the cost that big online retailers are spending to reach consumers today.

Although Carvana continues to grow, they don’t compare to the scale of Walmart, which sells more than Costco, Kmart, Kroger and Apple combined.

CarSaver at Walmart is powered by thousands of Certified Dealers who have exclusive access to Walmart’s 250 million customers and 1.7 milliion employees. Certified Dealers and their inventory are on the CarSaver program site, which is promoted on Walmart.com, in the Walmart App and in Walmart superstores across the country. Over 140 million consumers visit Walmart superstores each and every week, and Walmart.com is the fourth largest search engine in the U.S. with 127 million unique visitors per month. Dealers get unlimited impressions, leads, appointments and sales.

Through Walmart’s Auto Buying Program, customers are exclusively connected with only one dealer, so they don’t get bombarded with emails from multiple dealerships.

“The biggest advantage to us is that they aren’t sending the same lead to multiple dealers, because that kills the customer experience and our closing ratio. They follow up with all the leads to schedule appointments for us, and since the appointments are exclusive, they close at a higher rate than leads that are shot-gunned to all our competitors,” said Brian Benstock, partner at Paragon Honda & Acura, the top selling Honda/Acura store in the country.

The program comes at an opportune time for dealers that are struggling to compete with online retailers, some of which aim to replace dealers altogether. Program details are available at CarSaverDealers.com.

Reinvent Retail

From groceries to home cleaning supplies, consumers are accustomed to using the web to get everything they need without leaving their homes. Due to the rapid increase in online shopping, the industry is scrambling to find solutions to make it easier for consumers to complete 100 percent of the transaction on the web, without having to visit a dealership.

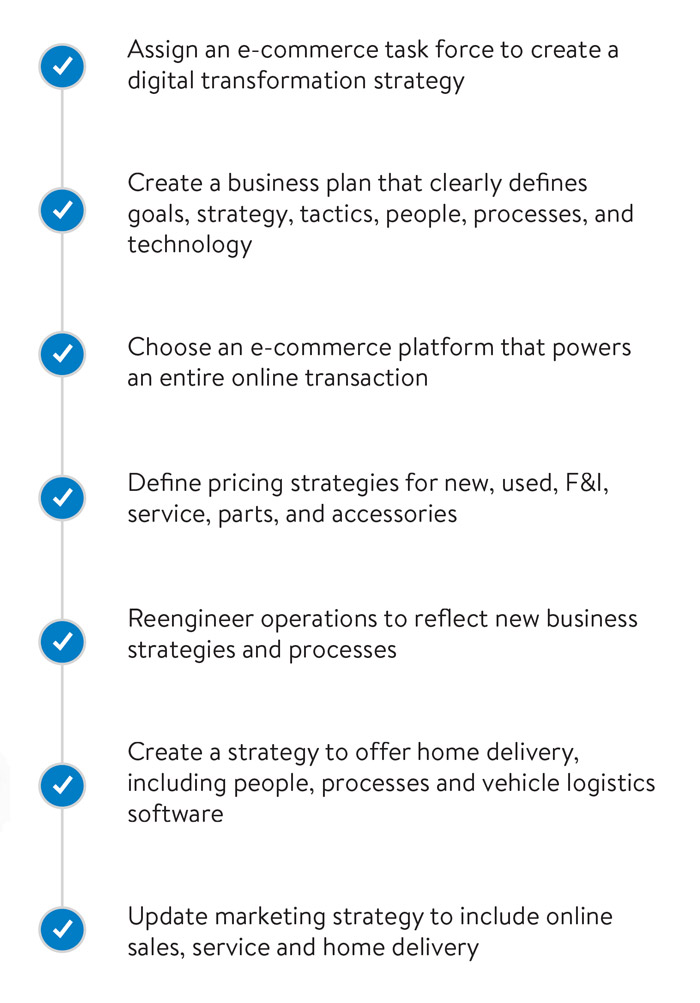

The time to reinvent is now. Traditional thinking no longer works in this dynamically changing marketplace. Now is the time to completely rethink and reengineer business models and to reinvent retail. Online sales are spiking to unprecedented levels, so sellers must follow or be left behind, and whoever acts fast now could enjoy a significant advantage for years to come.

AUTOMOTIVE E-COMMERCE READINESS CHECKLIST

AUTOMOTIVE E-COMMERCE PLATFORM COMPARISON

Selecting and onboarding the necessary digital retail technology to grow online sales and service is a massive undertaking. One of the biggest challenges for OEMs and retailers is finding the right technology to power the entire transaction online. This chart highlights the functionality required to power online transactions and a comparison of what market leaders are offering to consumers. All the below platforms are proprietary and not available to be licensed, except for CarSaver’s platform, which is being licensed by Walmart and car companies to power their digital retail internationally.

Each of these platforms has its own advantages and each player impacts a different part of the market. Tesla is the first and only car company selling new cars completely online at scale, taking market share primarily from traditional car companies who are late to offer online buying. Carvana and Vroom are market leaders in used vehicles, taking market share primarily from franchised and independent dealerships. Walmart’s online platform offers both new and used cars, in partnership with car companies and franchised dealers.