By Katerina Jones, vice president, marketing and business development at Fleet Advantage, a leading innovator in truck fleet business analytics, equipment financing and life cycle cost management.

Prior to 2021, automotive retailers were on a decades-old hunt to find the next credit-qualified shopper who was interested in a new set of wheels.

This past year, that same auto retailer has had plenty of buyers. It’s the cars and trucks they’re most in need of.

In showrooms across the USA, consumers are buying most makes and models almost as fast as they can be made or resold. This frenetic activity is based on the struggle of automotive OEMs to increase production because of a shortage of computer chips, and a strong economic recovery with favorable interest rates further incentivizing Americans to make their way to the dealership.

These two factors have left retailers struggling to keep cars and trucks on their lots. Many dealers are getting more aggressive in enticing drivers in the service lanes to trade in their cars earlier so they can boost their used-vehicle inventory.

This situation has also made one critical aspect of the entire automotive retail landscape even more critical to the success of each transaction – the reliability of auto haulers.

Auto hauler carriers have their own truck or fleet of trucks, and the vast majority of OEMs have their own private fleet of carriers used to transport cars and trucks from the factory to individual retailers. There are also individual broker companies that provide auto carriers on a for-hire basis.

Either way, reliability is extremely important, especially today when the delivery of each shipment can mean the difference between a sale or no sale. In addition to reliability, these companies have their own businesses and bottom lines to adhere to, which means they must procure their trucks with operational and financial flexibility in mind to constantly keep newer, reliable trucks on the road for the delivery of vehicles to their retail partners and customers.

Many of these companies must make strategic organizational decisions that can impact their bottom lines when determining the right procurement strategies to upgrade hundreds of aging trucks in their fleets. The costs involved can be significant depending on the type of investment structure (lease versus purchase), and even as more companies shorten their equipment life cycles through leasing, many firms are realizing that not all lease agreements are equal.

Companies in a full-service lease (FSL) already know it is not a flexible option. But it is also critical to understand the many variables and costs under an FSL program when compared to an unbundled lease (UBL) agreement. Some organizations have suffered from an inability to exercise this much-needed flexibility through a full-service lease structure for their trucks, which binds them in a lease contract over a specified period of time.

With flexibility at the forefront of the business strategy of operating a fleet of carriers, scrutinizing every detail of a fleet’s lease structure can mean the difference of millions gained or lost toward the bottom line, which can be detrimental when organizations need to preserve every penny for profits today.

Full-Service Leasing Defined

Full-service lease is a lease in which the lessor provides financing and other transportation services packaged in a single monthly payment. Full-Service transactions are often that, just transactions and the contracts are tenured and strategically designed to avoid high impact deal breakers.

In an FSL agreement, carriers essentially hand over all decisions affecting the fuel and maintenance costs to their lease provider and instead focus on a “bundled” monthly payment.

While on the surface, this may sound like a marriage of convenience, full-service leasing eliminates flexibility since it locks the organization into a rigid contract and terms for a set long-term period, wherein the cost for maintenance and finance are combined along with general overhead costs. Unfortunately, limiting the operational flexibility can be disastrous when business conditions change.

Unbundled Leasing: Flexibility & Competitive Costs

In contrast, UBL agreements are designed for carriers to work with a provider that can help break out costs individually and identify the lowest-possible financial costs involved with operating a fleet, including fuel economy efficiency, and eliminating unnecessary maintenance and repair costs.

A UBL offers flexible financing options based on actual costs; not what costs were projected at the onset of the decision process. UBL offers truck life cycle management for better cost and performance optimization. In a UBL agreement, companies have greater flexibility on these individual costs and the freedom to upgrade and scale the size of their carrier fleet, guaranteeing the lowest-possible financial costs involved with truck acquisition.

Significant Cost Savings Involved when Unbundling

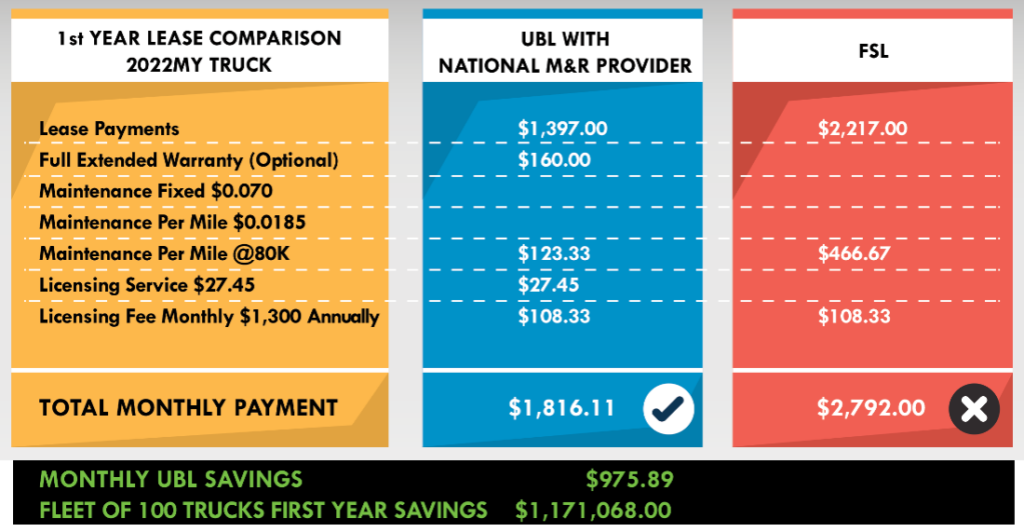

The monthly cost savings can be significant. After taking into account the lease payments, warranty and maintenance fees, an organization pays either an average of $1,816.11 per month (unbundled) compared with $2,792.00 per month (FSL). When calculated over a span of 100 trucks, that fleet would experience a first-year savings of approximately $1.2 million toward the bottom line3.

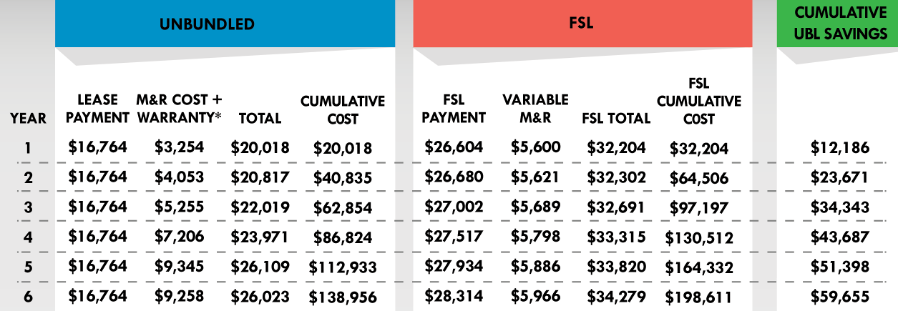

These monthly costs are further exemplified when finance costs are also taken into account. Finance costs are a significant calculation in any equipment acquisition. Purchase or lease requires a cap cost number and a finance number. The most effective process to reduce the truck cost and finance cost is to have competitive equipment and finance options. Access to multiple truck original equipment manufacturers and lenders is key to obtaining the lowest equipment and finance cost. These competitive options can be achieved when lease agreements are unbundled, allowing the freedom and flexibility to shop for the most competitive options available. The cumulative per-truck savings over a six-year life cycle amounts to $60,000, or roughly $6 million for a fleet with 100 trucks3.

The need for organizations to adapt through flexibility is no longer just a buzzword, it’s a competitive strategy. And in the current landscape of automotive where every shipment if vehicles can drastically alter the bottom line, it has never been more important for auto carriers to operate with agility in mind to keep a reliable fleet of trucks on the road and in position to make that next shipment of vehicles in a timely delivery.

For more information, visit FleetAdvantage.com.