A comprehensive guide to contactless commerce & e-commerce platforms

Digital Retail Transformation

In less than 60 days—not 60 weeks, much less 60 months—massive and unprecedented changes have been thrust upon the industry, and our organizational ability to react has become, quite literally, existential.

While e-commerce has become the norm for all manner of goods—books, travel, groceries, electronics—auto sales have lagged behind, still requiring a visit to the dealership to complete the transaction. Customers have few options for buying cars online, among them Carvana and Vroom, sellers of used cars; Tesla and CarSaver at Walmart, who sell both new and used cars.

While the majority of car companies and dealers use the web solely as a tool to drive consumers to showrooms, these well-funded newcomers are using the web as a tool to drive sales online. With consumers forced into their homes by the coronavirus pandemic, online sales have spiked to unprecedented levels and these well-funded digital disruptors are poised to take a sizable bite out of the market.

Mike Jackson, AutoNation’s CEO, said online sales continue increasing even after stay-at-home restrictions were eased. “This is what the industry has needed to do for a long time,” he said. “This is an inflection point, a strategic shift, and it’s not going back.”

In this article, we share best practices of the biggest and best players online, along with the technology they use to deliver a seamless online experience at scale. We explore what online buyers expect, who is meeting those expectations, where the industry is falling short and how you can fill the gap.

Online Buyer References

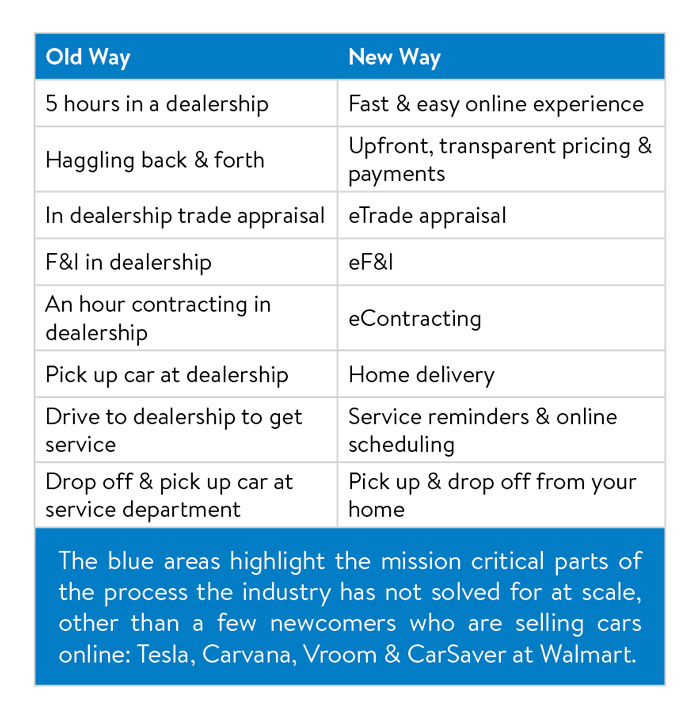

The most successful companies deliver a world-class customer experience by removing all the friction for consumers. This begins with replacing the hassle of haggling with transparent and upfront pricing; creating a fast and easy online buying experience; and saving consumers hours of waiting at the dealership with home delivery. But that’s easier said than done. Most industry players aren’t equipped with the people, processes or technology to deliver a frictionless experience that doesn’t require a visit to the dealership.

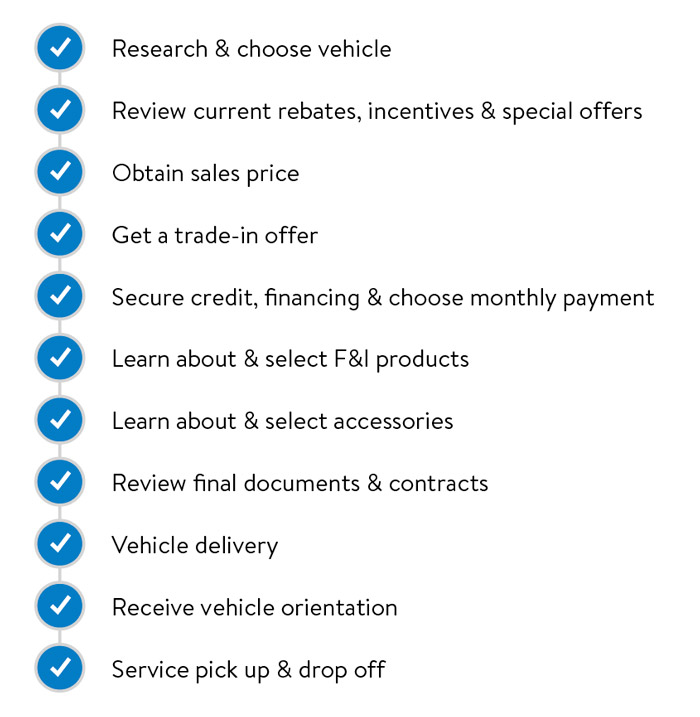

Below is a summary of what customers say they want when buying a car online.

Online Buyer’s Journey

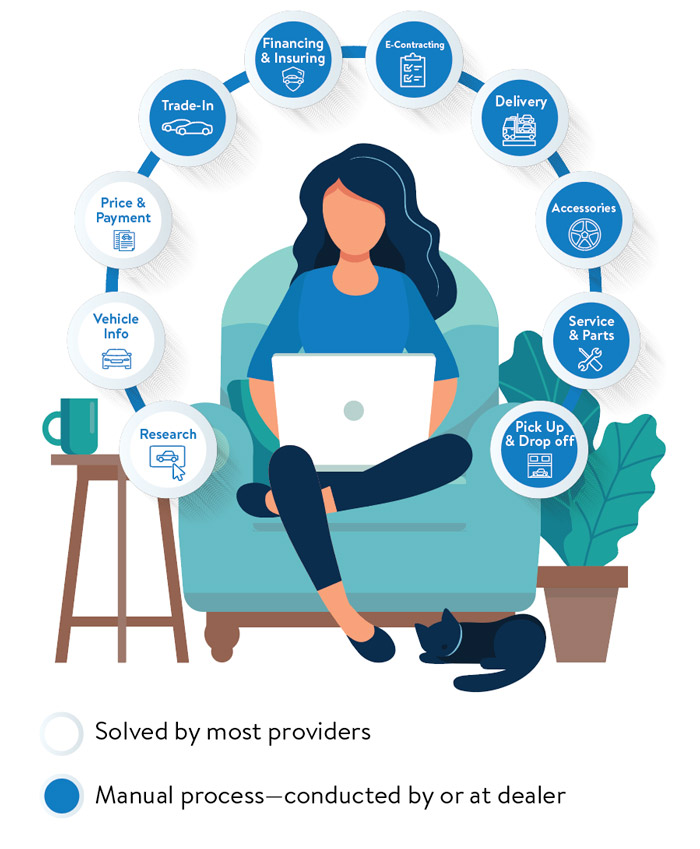

Below is a summary of the online buyer’s journey with the most challenging areas for OEMs and dealers highlighted in blue.

Digital Disruptors Dominate Online

Digital disruptors like Tesla, Carvana, Vroom and Walmart have positioned themselves to meet the growing demand from online car buyers that traditional car companies and dealers haven’t met. Tesla sells new and used cars direct to consumers; Carvana and Vroom sell used cars direct to consumers; and Walmart sells both new and used cars through a network of dealers that represent all top brands.

Some of these companies are public and have enough capital to significantly disrupt the industry. Carvana is currently valued above $14 billion and Tesla at over $140 billion, partly because the market perceives they’re positioned to win in the new digital economy. All these newcomers compete directly with traditional car companies and dealers, except Walmart, who chose to partner with the industry to help their 250 million customers buy online.

Tesla

The auto industry has a long history of maverick companies and CEOs challenging the status quo by offering a better way to build and sell cars. Today, that maverick is Elon Musk, founder of Tesla. When Tesla launched in 2012, consumers could buy through retail stores. But in 2019, Tesla decided to close its stores, opting to sell its new Model 3 solely online. As a result, Tesla sold more cars, in more states, at less cost.

Currently, Tesla has a market cap that’s more than quadruple GM’s and sevenfold that of Ford, even though the two auto giants sell 10 times more cars a year. The reason lies partly in Tesla’s design and early focus on electric vehicles. But these two factors alone can’t account for that massive discrepancy. Rather, Tesla’s use of digital technology to acquire and retain new legions of customers who prefer to transact entirely over the web has been a key (though certainly less trumpeted) driver of its success. In doing so, Tesla has pushed other manufacturers and retailers to explore ways to expand their own online efforts.

“It’s just so easy to buy a Tesla—it’s three clicks, and that’s about as many clicks as it takes to buy catnip on Amazon.”

Adam Jonas, Morgan Stanley Analyst

Carvana

Carvana sells used cars online, and their inventory is available to deliver anywhere in the country. After customers select a car, they’re presented with price, tax, license, fees, payments, terms of the loan, interest rate, down payment and trade-in value transparently disclosed upfront. Customers can choose to have the vehicle delivered to their homes or to one of the company’s 24 delivery kiosks. Carvana also provides a 90-day warranty and a seven-day test drive, with the option to return the car by the end of the first week if the customer isn’t satisfied.

“This is what consumers want and expect now. The product comes to you. You don’t go to the product.”

Ernest Garcia III, CEO of Carvana

Vroom

Vroom is another online used car dealer that allows consumers to finish the entire car-buying transaction online. The company offers financing and delivers cars to customers nationwide. Vroom also provides a seven-day, money-back guarantee and a 90-day bumper-to-bumper warranty. “Our goal is to make buying through Vroom as easy as ordering a pizza,” said Vroom Chief Conversion and Product Officer John Caine. “Consumers are becoming so comfortable buying online and that has extended to autos and real estate.” Vroom isn’t public, like some of the companies mentioned above, but they’ve raised hundreds of millions to enhance their online sales platform and offering.

CarSaver

Walmart is currently rolling out a national online auto buying platform, CarSaver at Walmart, to help their 250 million customers save time and money when they buy, finance, lease and insure all brands of new and used cars. Similar to the others, consumers can do everything online, have the vehicle delivered to their door, and it comes with a money-back guarantee and lifetime warranty. While the other newcomers compete directly with traditional car companies and dealers, Walmart chose to partner with them, to offer all top brands of new and pre-owned vehicles through a network of franchised dealers who have committed to provide fair pricing and the highest level of customer service to Walmart’s customers. The program comes at an opportune time for dealers, who are struggling to compete with well-funded online retailers aiming to replace them altogether. Dealers looking for ways to protect their turf have found an unexpected friend in Walmart, who is providing unprecedented access to hundreds of millions of customers through a digital retail platform that makes it easy for buyers and sellers to conduct contactless commerce. Car companies are also white labelling the CarSaver platform to power their online sales and to give their dealer network a platform that enables online transactions and home delivery.

Reinvent Retail

From groceries to home cleaning supplies, consumers are accustomed to using the web to get everything they need without leaving their homes. Due to the rapid increase in online shopping, the industry is scrambling to find solutions to make it easier for consumers to complete 100% of the transaction on the web, without having to visit a dealership. The time to reinvent is now. Traditional thinking no longer works in this dynamically changing marketplace. Now is the time to think different, to completely rethink and reengineer business models and to reinvent retail. Online sales are spiking to unprecedented levels, so sellers must follow or be left behind, and whoever acts fast now could enjoy a significant advantage for years to come.

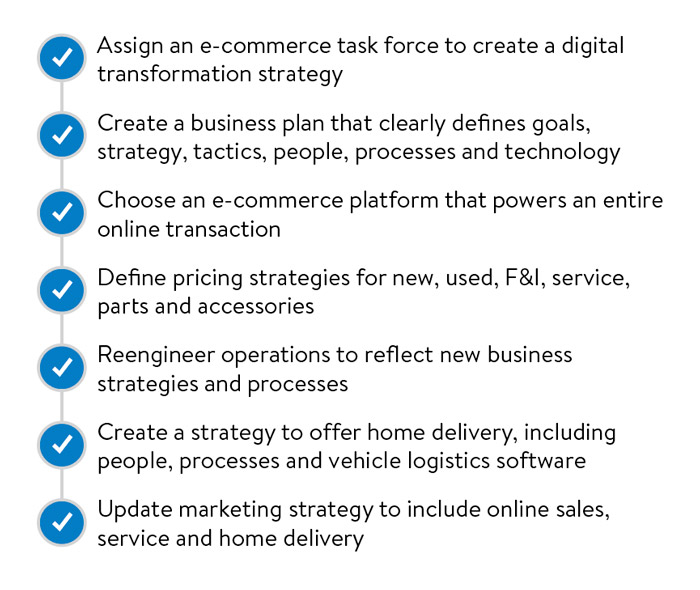

Automotive E-Commerce Readiness Checklist

Automotive E-Commerce Platform Comparison

Selecting and onboarding the necessary digital retail technology to grow online sales and service is a massive undertaking. One of the biggest challenges for OEMs and retailers is finding the right technology to power the entire transaction online. This chart highlights the functionality required to power online transactions and a comparison of what market leaders are offering to consumers.

Each of these platforms has its own advantages and each player impacts a different part of the market. Tesla is the first and only car company selling new cars completely online at scale, taking market share primarily from traditional car companies who are late to offer online buying. Carvana and Vroom are market leaders in used vehicles, taking market share primarily from franchised and independent dealerships. Walmart’s online platform offers both new and used cars, in partnership with car companies and franchised dealers.