Work Truck Solutions released their Q2, 2023 Commercial Vehicle Market Analysis today. The commercial vehicle market continues to grow with significant upward trends in inventory and sales.

Inventory

• New average on-lot inventory per dealer experienced strong growth, up 24.8% Quarter-over-Quarter (QoQ) and 70.5% Year-over-Year (YoY). Continuing demand combined with increasing inventory suggests we can expect sales to grow throughout the balance of 2023.

• Evidence of the turmoil in the automotive supply chain over the last year is seen in the dramatic 35.3% YoY used on-lot per dealer inventory increase.

• EV on-lot inventory also saw an upward trend with a 9.7% QoQ increase in new Hybrid/Electric commercial vehicles per dealer, and a 13.3% increase YoY.

Prices

• Average prices of new commercial vehicles fell 2.1% QoQ after experiencing three straight quarters of increase. However, average prices YoY were still up 3.4%.

• Average prices of used commercial vehicles showed an increase of 2.1% QoQ but a 7.6% YoY drop.

Sales

• Sales of new vehicles enjoyed a significant 20.8% increase in both QoQ and YoY. The large influx of inventory hitting lots in Q1 was likely responsible for the increased movement in Q2, as dealers could fulfill more of the pent-up demand for work trucks and vans.

• Used vehicle sales also had a strong showing when examining YoY numbers, with average sales of work trucks/vans per dealer increasing 42.3% YoY, but a slight drop QoQ of 3.0%. The fact that YoY used work trucks and vans posted such positive sales numbers, despite the median mileage climbing 5.0% YoY demonstrates their important position in the commercial market.

• Hybrid/EV sales have remained cautiously steady over the last five quarters, showing a decent appetite for alt-fuel options within the market. However, lagging availability and minimal charging infrastructure continue to contribute to a somewhat guarded adoption by business owners.

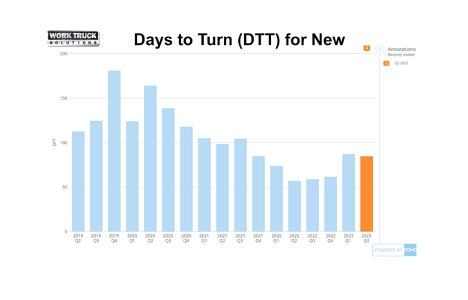

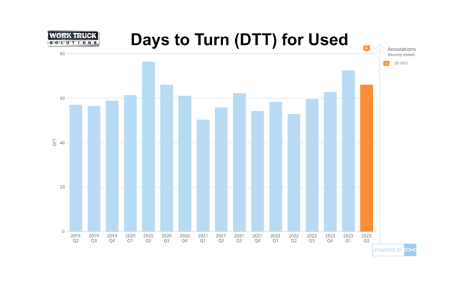

Days to Turn

• After three straight quarters of increasing Days to Turn (DTT) for new vehicles overall, data showed a slight dip with a 2.3% QoQ decrease, while the YoY DTT increased by 48.2%.

• Used vehicle movement also improved in Q2 with an average DTT QoQ decrease of 9.6%, although YoY DTT increased by 25%.

“Our Q2 2023 analysis indicates that the commercial vehicle industry is experiencing significant growth, despite current economic uncertainties,” stated Aaron Johnson, CEO of Work Truck Solutions. “For dealers, and the industry at large, success in adapting to these changes lies in the utilization of digital tools and making informed decisions guided by data specific to commercial operations. Catering to the evolving needs of business customers paves the way for continued growth and success.”

Work Truck Solutions continues to monitor and analyze the market to provide valuable insights to dealers and buyers alike.