Stay-at-home orders were enacted across the United States through much of 2020 and consequently many vehicle owners drove fewer miles, which extended the interval between service visits. However, dealer service visits are only down 6% from the previous year and overall satisfaction increases to 847 (on a 1,000-point scale) from 837 a year ago, according to the J.D. Power 2021 Customer Service Index (CSI) Study. Overall satisfaction also increases for a sixth consecutive year.

“When one- to three-year-old vehicles required service in 2020, dealers captured an even greater share of service visits, which is the highest level in at least five years,” said Chris Sutton, vice president of automotive retail at J.D. Power. “Dealerships made the most out of a disruptively bad situation.

“Completing work right the first time, as well as focusing on customers’ needs, play significant roles in satisfaction — and dealers are nailing these key performance indicators nearly 100% of the time. By continuing to provide an exceptional service experience, dealers have an opportunity to seize an even greater share of the market. It’s notable, too, that while service was less frequent in 2020, customers responded very well to convenience services such as vehicle pick-up and drop-off at their home.”

The study measures satisfaction with service at a franchised dealer or independent service facility for maintenance or repair work among owners and lessees of one- to three-year-old vehicles. It also provides a numerical index ranking of the highest-performing automotive brands sold in the United States, which is based on the combined scores of five different measures that comprise the vehicle owner service experience. These measures are (in order of importance) service quality (29%); service facility (19%); service initiation (18%); service advisor (18%); and vehicle pick-up (16%).

Following are key findings of the 2021 study:

- Remote or online payment options boost satisfaction: While service customers didn’t frequently use contactless payment options — only 6% of premium and 1% of mass market owners say they used these methods — pick-up satisfaction is highest among those who used these options. Satisfaction scores improve 44 points among premium customers who pay remotely or online compared with handling payment via a cashier. Among mass market customers, satisfaction improves 69 points. “This is an example of a process some dealers may have put into place as a safety measure during the pandemic, but which they may want to keep in place, as customers find they like it more,” Sutton said.

- Using express service increases satisfaction: Satisfaction among customers who did not use express service for maintenance is flat compared with a year ago. However, satisfaction among those who did use express service has increased 10 points during the pandemic.

- Battery-electric vehicle owners less satisfied with service: According to the J.D. Power 2021 Electric Vehicle Experience (EVX) Ownership Study, only 54% of battery electric vehicle (BEV) owners indicate they had taken their vehicle in for service in the past 12 months. However, the 2021 CSI Study finds that when they do visit a dealer for service, their overall service satisfaction is 69 points lower than the average customer and 76 points lower for service quality. “BEV owners present a unique challenge for dealers,” Sutton said. “Not only are their vehicles more difficult to service than traditional internal combustion engine vehicles, but also the lower frequency of visits means dealers have fewer chances to make a positive impression on these customers.”

- BEV owners less satisfied with maintenance than repairs: On average, there’s nearly twice as much maintenance work being done during dealer service visits than repair work. However, the maintenance-to-repair ratio for BEV owners is nearly an even split. While more complex service repair work usually results in lower customer satisfaction than does maintenance work, the opposite is true for BEV owners. A large reason for this is that BEV owners are 2.5 times more likely to not experience their service completed right the first time. “BEVs are in their early stages and dealers seem to be experiencing growing pains with servicing these vehicles,” Sutton said. “Automakers may want to invest in more dealer service training. Otherwise, they run the risk of losing return customers.”

Study Rankings

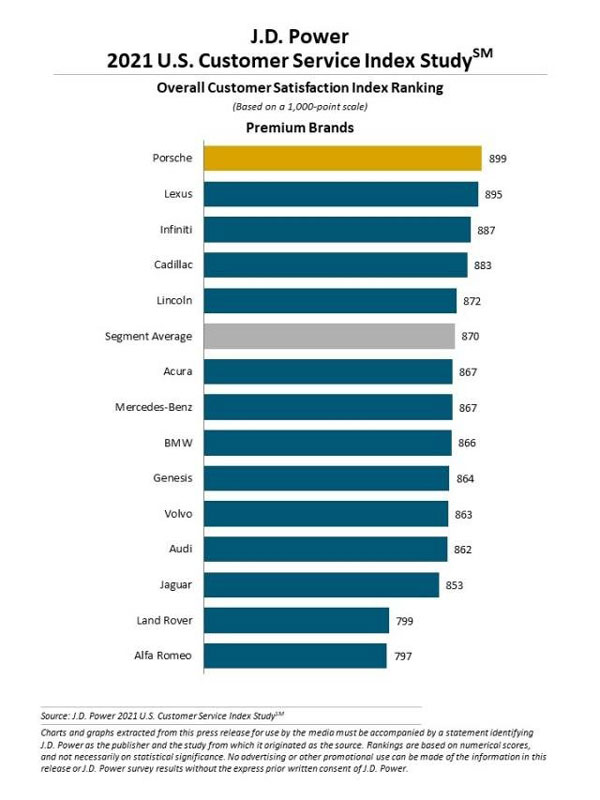

Porsche ranks highest in satisfaction with dealer service among premium brands with a score of 899. Lexus (895) ranks second, followed by Infiniti (887), Cadillac (883) and Lincoln (872).

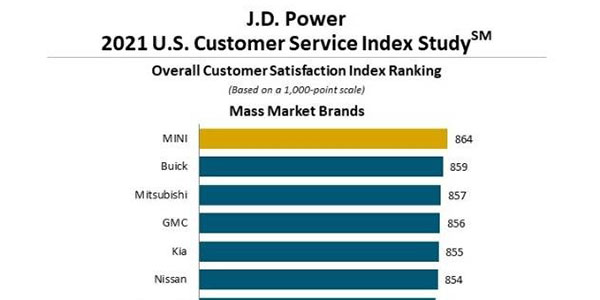

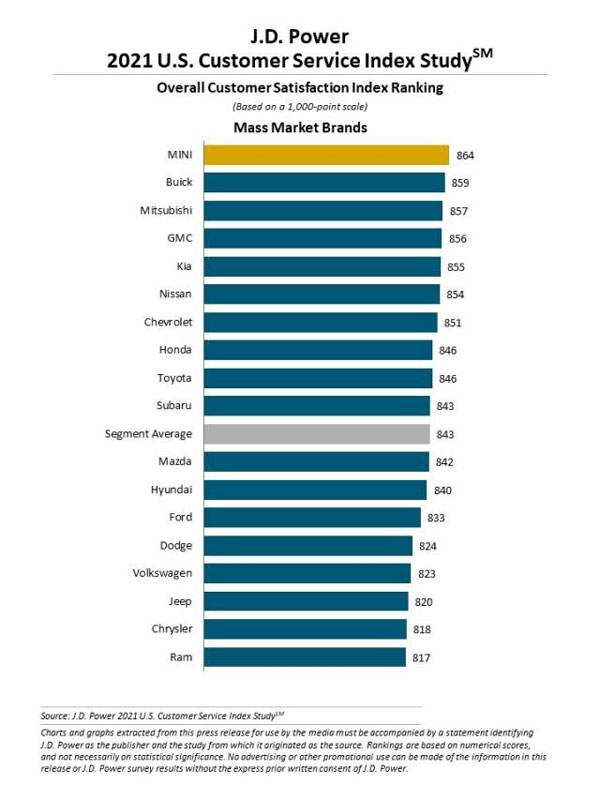

MINI ranks highest in satisfaction with dealer service among mass market brands, with a score of 864. Buick (859) ranks second, followed by Mitsubishi (857), GMC (856) and Kia (855).

The 2021 U.S. Customer Service Index Study is based on responses from 62,519 verified registered owners and lessees of 2018 to 2020 model-year vehicles. J.D. Power goes to great lengths to ensure that survey respondents are true owners of the brand they are representing. The study was fielded from July through December 2020.

For more information about the U.S. Customer Service Index (CSI) Study, visit https://www.jdpower.com/business/automotive/us-customer-service-index-csi-study.