Without an offensive posture determined to save your company money, economic insecurities, supply chain disruptions and managing a challenging workforce can influence companies to be more reactive, adjusting to the ever-changing rules and guidelines. Now is the time to be proactive, but most business owners cannot invest the hours to become a financial expert and stay current with the latest tax strategies.

Businesses need a partner whose primary focus is to make companies more profitable. This can be accomplished through operational, insurance and tax strategies by minimizing your income tax so you can maximize your working capital to strengthen your company. We want to share six strategies you should consider to increase profitability at your dealership:

1. Conduct a Utility Audit

A utility audit company can get you refunded for past overcharges while also saving on future bills. They will look back three years on your utility bills and determine if you have any bills you should not be paying. On average, 80-95% of companies qualify for a refund. They will also do an annual review for the next three years to help you find any additional savings.

2. Eliminate Credit Card Charges

Credit card fees are changing dramatically. By using a merchant processing platform that lowers your monthly merchant credit card processing fee by up to 15-20%, you can reduce or eliminate your credit card fees. You can also receive a potential rebate, putting money back in your pocket.

3. Apply for the Employee Retention Credit

Employee Retention Credits (ERC) came out the same time as Paycheck Protection Program (PPP) loans as an incentive program to help stimulate the economy during the pandemic. Originally, you could choose either a PPP loan or ERC. At the end of 2020, Congress decided you could get both, as long as you back out the money received from your PPP loan employee forgiveness as well as other requirements. There are two ways to qualify for the ERC:

1. Drop in sales of 50% from 2019 to 2020 or a 20% decline by quarter for the first three quarters of 2019 compared to 2021.

2. A business disruption caused by a governmental mandate. This second method is the area that our tax attorney qualifies most auto dealers as eligible.

If you have been told that you don’t qualify as a new/used vehicle dealer, it is worth a call to explain why you might.

4. Rethink Health Insurance

The American Healthcare Act has afforded the creation of programs beneficial to both the employer and the employee. These unique health insurance plans incorporate healthy lifestyle strategies that can make you as a business owner approximately $500 per employee per year. In addition, employees can save up to $1,800 per year by participating in the healthy lifestyle campaign. Look for partners who manage all the details and allow you to add this benefit without changing the quality of care or even changing insurance companies.

5. Be Proactive with Tax Planning

Tax planning is not planning how much tax you have to pay; tax planning is planning on how to minimize your tax liability by utilizing tax strategies. An advisor can help you reduce your adjusted gross income through charitable strategies and tax-deductible investments. This is a more customized approach and is worth a conversation.

6. Defer Your Capital Gains

If you are selling your dealership at any point, you could be facing substantial capital gains. Your advisor can recommend strategies to defer capital gains, thereby enabling you to earn investment income on what you would otherwise pay in taxes. FDIC limits can also be increased on cash balances above $1 million.

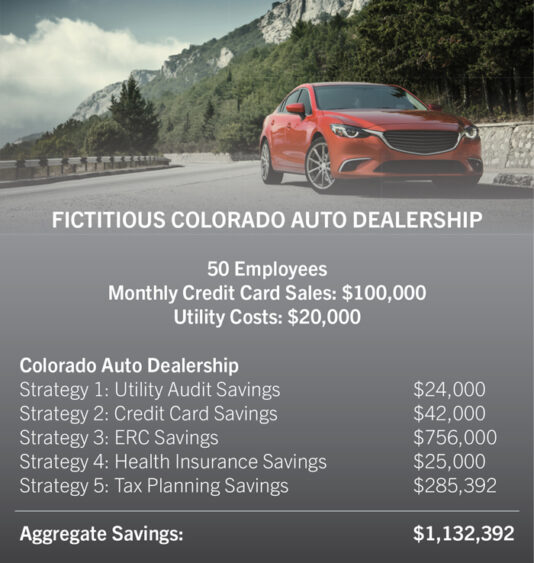

To give you an idea on the cost savings if you took advantage of these strategies, the following is a sample company “Colorado Auto Dealership” with potential savings.

As you can see, there are substantial savings in each strategy that your company could capitalize on. All of these strategies require no up-front cost to you, other than your time. By shifting to an offensive posture, you could save your company hundreds of thousands of dollars.