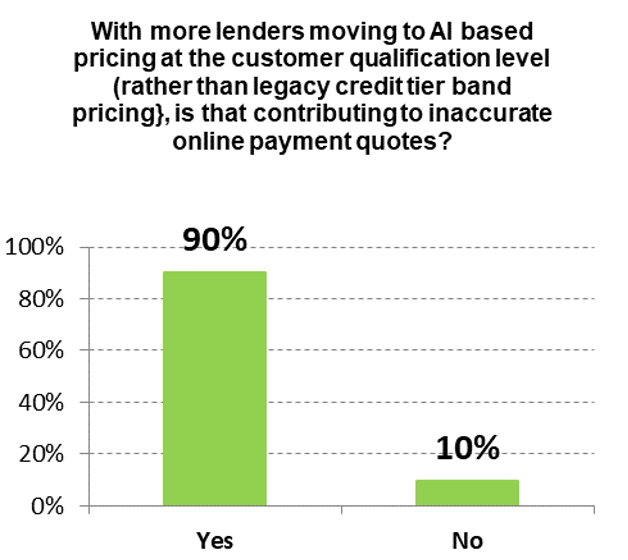

A new snapshot survey of auto dealers and lenders, from automotive fintech innovator eLEND Solutions, reveals that 90% believe that AI-based pricing is contributing to inaccurate online payment quotes which, the vast majority say, is having an adverse impact on the buying experience.

Other key obstacles to delivering accurate online payment quotes, cited by survey respondents, include a reduction in lender transparency, mistimed and mismatched desking/lender decisions, and reliance on consumer-provided credit scores, all of which are contributing to payment quotes that are anything but “penny perfect.”

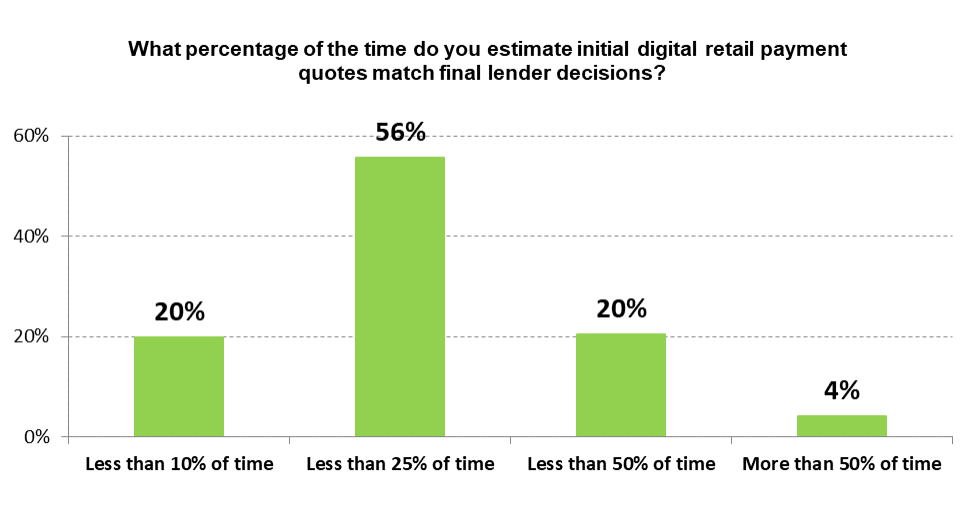

“Over three-quarters of dealers and lenders in our survey say that the desked-deal and final decision match 50% or less of the time,” said Pete MacInnis, founder and CEO of eLEND Solutions. “That is an astonishing number, but one that doesn’t surprise us. This mismatch, born of multiple factors uncovered in our survey, creates deep friction in the buying process, impacting CSI, profits and more.”

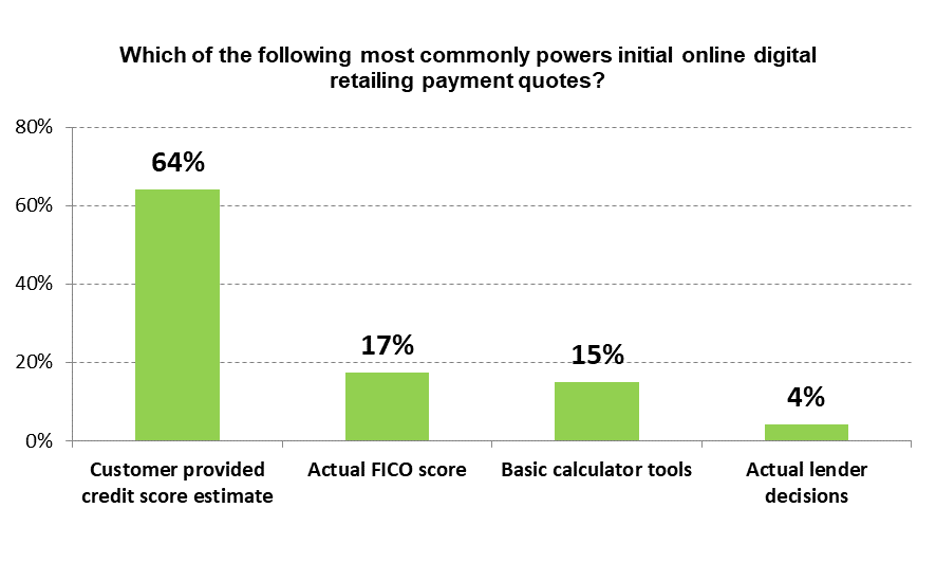

One of the Achilles’ heels of accurate payment quotes is the lack of relevant, objective information actually driving online payment quotes: according to 64% of dealer/lender respondents, today’s online quotes are primarily driven by consumer-providedcredit score information.

That, coupled with a faulty perception of what ‘penny-perfect payments’ in digital retailing actually means — 57% tie it to jurisdiction sales tax, license and registration fees versus those details PLUSactual customer pre-qualified to a specific lender decision (43%) — makes it no mystery why, for the vast majority (76%), digital retail payment quotes match final lender decisions less than 25% of the time, with only 4% saying they match more than 50% of the time.

Adding further challenge is the fact that over half of lenders and dealers report that payment terms are negotiated with the online customer before a lender decision. “Talk about putting the cart before the horse,” said MacInnis. “Negotiating payment terms before a lender decision is a recipe for consumer dissatisfaction and deal rewinds.” In fact, over 70% of respondents agree that having finance involved in the deal flowprior to the first pencil, digitally or otherwise, would improve the process for all parties.

The snap survey was conducted by eLEND Solutions online among over 300 auto dealers/lenders in December 2023. While the survey respondents were predominantly auto dealers (76% dealer/24% lender), the results were extraordinarily consistent across both cohorts.

“It was important for us to hear from lenders in this survey and it was remarkable how in sync they were with dealers: for example, the vast majority of both segments agree that not only has there been a reduction in lenders providing critical rate sheet pricing bulletins (87%), but also that AI-based pricing is a key culprit of inaccurate payment quotes (90%),” said MacInnis.

Lenders and dealers also appear to be aligned in what it will take to solve these challenges: 94% say that pre-desking technology, integrated with lender proprietary credit scorecard models, would improve the car buying/selling experience for all parties.

“The challenges to today’s digital finance are solvable, but only when our industry is willing to come together to change processes, increase transparency and embrace tools that enable sales and finance to begin together at the start of the transaction,” continued MacInnis. “The last time we saw disruption around lender dealer communication was twenty years ago when the big players got together to eliminate the ‘faxes’ between dealers and lenders. The results of this survey clearly demonstrate that the time for collaboration on the next big disruption has come.”

Key Survey Takeaways

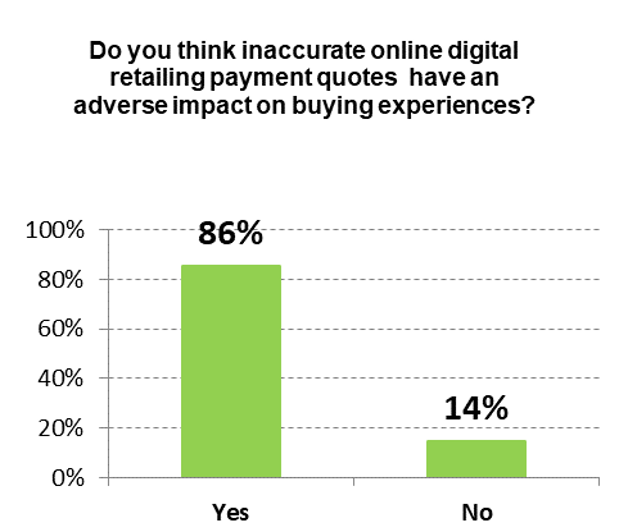

- 86% of respondents think inaccurate online digital retailing payment quotes have an adverse impact on buying experiences. (89% Dealers/84% of Lenders).

- 90% of respondents say that AI based pricing at the customer qualification level (rather than legacy credit tier band pricing}, is contributing to inaccurate online payment quotes. (91% Dealer/85% Lenders)

- The Digital Retailing term “Penny Perfect Payments” means “payments tied to jurisdiction sales tax, license and registration fees,” for 57% overall. Only 43% said “payments tied to jurisdiction sales tax, license and registration fees,” PLUSactual customer pre-qualified to a specific lender decision.” Lenders were more likely to say the latter (52%) than Dealers (42%)

- ‘Customer-provided credit score estimate’ is the feature that most commonly powers initial online digital retailing payment quotes, according to 64% of respondents; ‘actual FICO scores’ (17%), and ‘basic calculator tools’ (15%) lagged far behind, with ‘actual lender decisions’ dead last at 4%.

- Initial digital retail payment quotes match final lender decisions less than half the time say 96% of respondents, with 76% saying they match less than 25% of the time. (74% Dealers/79% Lenders)

- 87% overall agree that has there been a reduction in Lenders providing rate-sheet pricing bulletins (89% Dealers/83% Lenders)

- Lender loan pricing models are predominantly driven by ‘credit score plus other credit attributes and advance guidelines’ say 66% of Dealers and 57% of Lenders.

- 54% overall say that payment terms are negotiated with the online customer beforethe Lender decision.

- The desked deal matches final lender decisions less than 50% of the time say 72% of respondents.

- 74% agree that having finance involved in the deal flow prior to the first pencil, digitally or otherwise, would improve the process for all parties, with Dealers indexing higher (78%) on this than Lenders (69%)

- 94% overall say that pre-desking technology, integrated with lender proprietary credit scorecard models, would improve the car buying/selling experience for all parties. (94% Dealer/92% Lender).

For more information, visit www.elendsolutions.com.