By Richard Rodgers at Dannah Investment and Tom Dorywalski at Taylor Insurance

The healthcare system in America is a silo-styled system that is intentionally designed to be complicated. While currently ranked as the most expensive system in the world, it lacks transparency, is overly complex and regularly produces less than ideal outcomes for individuals.

Since 2000, employer-sponsored health insurance premiums have increased by over 250%, increasing from an average of $2,791 in 2000 to $7,911 in 2022 for employees. Health insurance premiums continue to increase and have now become one of the top three most expensive line items on a company’s P/L, creating tremendous stress on the employer’s ability to recruit and retain top talent. The crisis is made worse by the fact that many employers have “cost-shifted” expenses back to employees, with the average employee seeing deductibles of over $2,000 and overall annual risk exposure of over $8,000, per person.

As these expenses have placed extensive stress on businesses and their employees, the top insurance companies have enjoyed the most profitable multi-year run in their history. The most recent issue of Fortune magazine (June/July 2023) lists United Health Group at #5, CVS Health (Aetna) at #6 and Cigna at #15. In fact, there are 40 healthcare companies in the Fortune 500 and their combined revenue is $2.77 trillion, 15.3% of total Fortune 500 revenues! Profitability for these companies is staggering as United Health profits were $20.1 billion in 2022!

Combined with the economic challenges in a post-COVID economy, many employers believe that they don’t have a choice and throw their arms up in frustration. They are advised that the claims are the claims and there is nothing they can do about it by so many people in the system that this is now their truth.

Or is it? Over the last 10 years, self-funded health plans have become a strategy for a growing number of American businesses. Traditionally reserved for large organizations, self-funded contracts have evolved and are now safely available for groups as small as five lives. Self-funded, dual-funded and level-premium plans offer an affordable, secure alternative to fully insured plans.

Self-funded health plans are fully funded by employers. Dual-funded health plans utilize stop-loss insurance to cover health expenses that are more than established limits for the employer’s funding. The most recent strategy, level-premium, dual-funded plans allow employers to make monthly contributions to their health plan on a per-employee/per-month basis. The plans operate under evolved stop-loss contracts that reduce risk for small employers, often covering groups as low as five employees. All strategies are administered by a third-party administrator (TPA).

The primary advantage of self-funding health insurance plans is cost savings as employers only pay for the healthcare expenses that they incur. Many employers who implement self-funding experience overall savings ranging from $2,500 to $3,500 per employee per year on their health insurance expenses. This is accomplished through improved cash flow as self-funded plans pay only for claims that are incurred, not for claims that may be incurred.

Self-funding allows for greater flexibility and control of costs than traditional health insurance plans. Organizations can customize their health benefit plans to meet their specific needs and budgets instead of buying a one-size-fits-all plan.

Self-funding health insurance plans provide organizations with valuable data analytics and insights into their healthcare expenses. This allows organizations to identify trends, assess risk and make informed decisions about benefits and costs.

As organizations consider self-funded plans as a strategy, they should always start by choosing a broker/agent with the appropriate experience in the market to help them effectively evaluate options, including the right TPA. Choosing the right TPA for your company with the appropriate experience in self-funded plan administration is critical. Your broker and TPA will help you evaluate the integrated benefit options in the marketplace that will help you control your healthcare spending. They should also provide a service team acting as advocates for your company and your employees. Their primary purpose is to simplify healthcare so that you and your employees can make the appropriate decisions at the appropriate times.

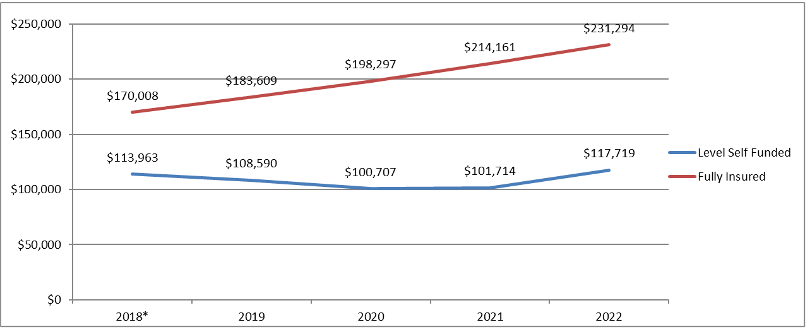

A small employer in South Georgia implementing this strategy for its 12 employees since June 2018 has saved over $454,000 from what they would have spent on a fully insured plan (see below). They have reinvested their premium savings back into their employees by reducing their employee annual deductible to $0!

Managing your healthcare supply chain is critical as the point of self-funding is not just to cover costs but to create savings. When done correctly, self-funding can provide employers of all sizes with a long-term strategy that reduces costs while improving health outcomes for your employees. A true employee benefit!