The ZeroSum Market First Report is the automotive industry’s first source to predict month-end vehicle movement, providing vital supply and demand trend data to automotive marketers and dealers. ZeroSum uses predictive modeling to accurately estimate new vehicle inventory, pricing trends, and market share.

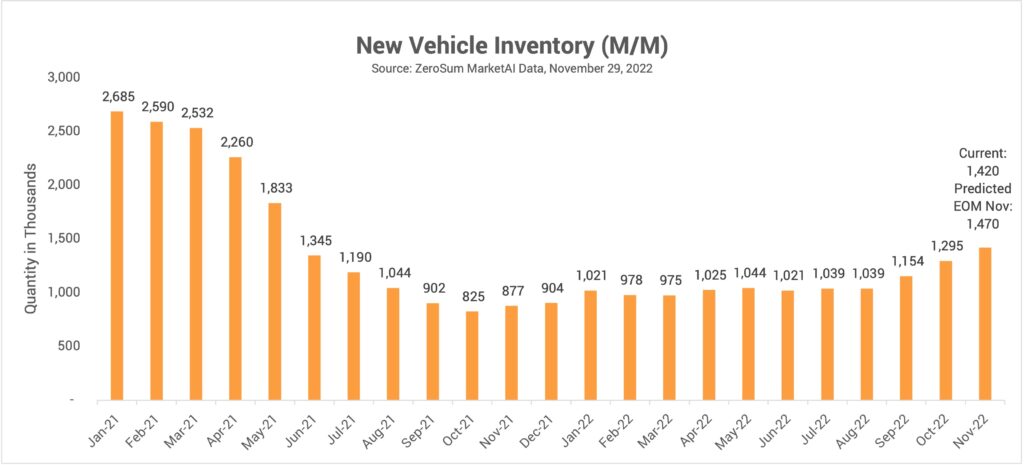

New vehicle inventory is at its highest level since mid-year 2021 as prices continue to rise and inversely used car inventory and prices are both falling. According to ZeroSum data, new vehicle inventory has increased another 9.64% since the start of October while used vehicle inventory has declined 2.61%. Despite more new cars being available, new car prices rose 0.76% this month to an average of $48,503. At the same time, used car inventory fell for the third straight month while prices dipped 1.55% to an average of $32,983.

Despite the lower used car prices, consumers are struggling to afford used cars following interest rate increases from the Fed. According to Cox Automotive analysts, the average monthly payment for a used vehicle is currently $551, 47% higher than in 2019 and is forecast to reach $570 by the end of the year. As a result, dealers should be prepared to retail fewer used vehicles than last year but should not be too concerned about profit losses. New vehicle sales are expected to be higher than at this time last year, aided by the influx of available inventory.

ZeroSum’s Take: What You Need to Know

Despite current high levels of new vehicle inventory, new car prices remain high. Dealers should capitalize on this opportunity by continuing to acquire and sell new cars.

Here are your key takeaways:

- Purchase used cars you know will sell. Don’t get stuck waiting for your cars to sell. Focus on acquiring the vehicles you can move off your lot the quickest.

- Closely monitor market prices and adjust quickly. With prices changing rapidly, watch the market every day and prepare to decrease prices to remain competitive as used car prices fall.

- Turn cars quickly and keep your inventory lean. Especially for cars that are higher in value or harder to sell, it will be crucial to reduce your days on lot and be selective with your inventory to maintain profitability.

To read the entire report and view supplemental charts, visit our website: