ALG Introduces Tesla to Monthly Forecast

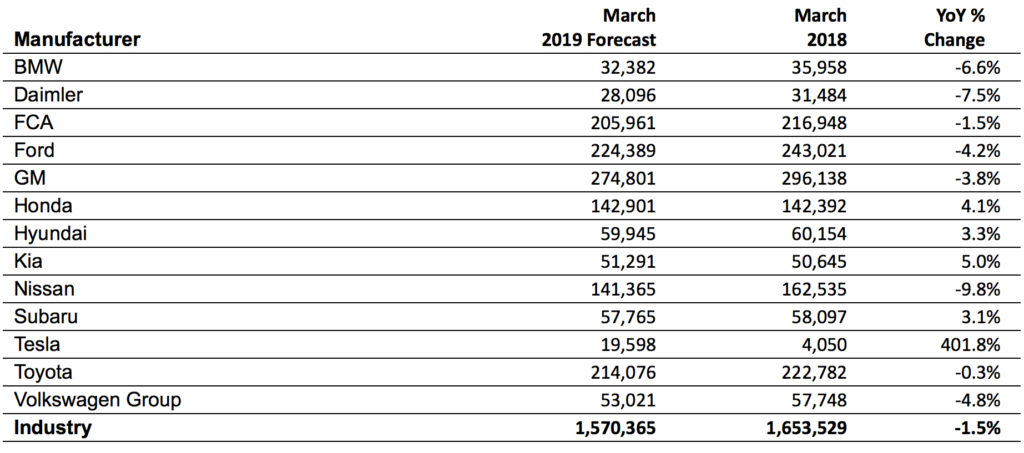

TrueCar, Inc.’s data and analytics subsidiary, ALG, projects total new vehicle sales will reach 1,570,365 units in March, down 1.5% from a year ago when adjusted for the same number of active selling days in 2018. This month’s seasonally adjusted annualized rate (SAAR) for total light vehicle sales is an estimated 17 million units for the month. Excluding fleet sales, ALG expects U.S. retail deliveries of new cars and light trucks to be 1,259,018 units, a decrease of 4.3% from a year ago, but an increase of 30% from last month, largely due to seasonality.

“The declines we’re seeing at the start of 2019 are not unexpected,” said Oliver Strauss, chief economist at TrueCar’s ALG. “Tariffs and the rising interest rate environment have made consumers a bit cautious; however, both the economy and the auto industry remain strong despite uncertainty about the future.”

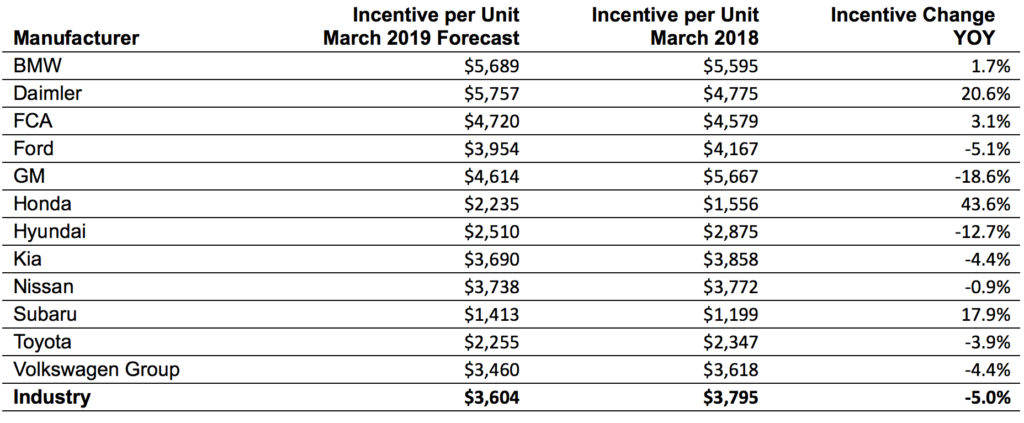

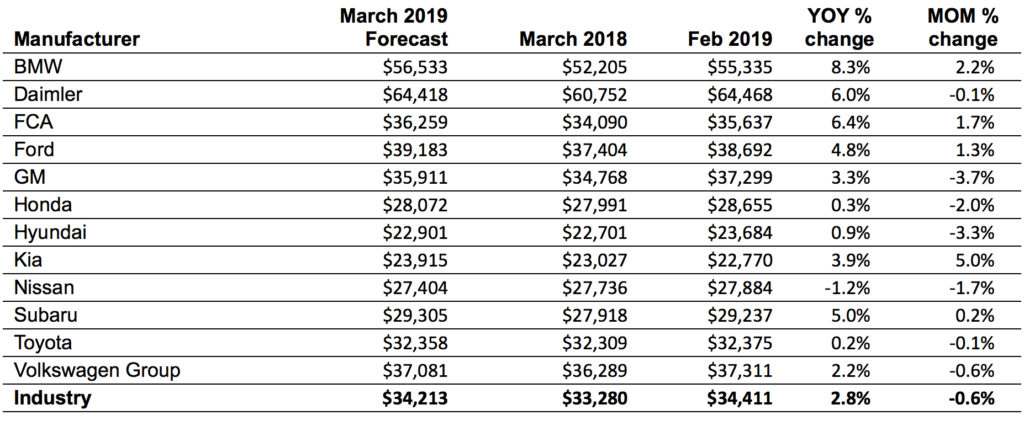

While automakers have historically raised incentives in times of economic uncertainty, ALG expects OEMs to continue decreasing their incentive spend. Average incentive spending by automakers should reach an estimated $3,604 per vehicle in March down $191 or 5% from a year ago, and up 0.1% or $5 from February 2019. For March, ALG estimates ATP for new light vehicles was $34,213, up 2.8% from a year ago while incentives as a percentage of ATP was at 10.5% down 0.9 percentage points year-over-year.

“Incentives are not as rich as they were last year,” said Eric Lyman, chief industry analyst for TrueCar’s ALG. “That’s a sign of balance in the automotive space as automakers are better aligning production and incentive spend with consumer demand. GM’s Cadillac and Chevrolet brands are showing the largest improvements in ALG’s Retail Health Index leading the luxury and mainstream sectors respectively in March.”

ALGs Retail Health Index (RHI) assesses whether OEMs are gaining market share through consumer demand or through incentives.

Due to Tesla’s increased volume, ALG is now publishing a sales forecast for the brand alongside its other automaker forecasts.

“The eyes of the automotive industry are fixed on Tesla now that the brand is competing at a transaction price that is more in line with mass market vehicles following the launch of the Model 3,” said Lyman.

Retail Health Index (Forecast)

RHI measures the changes in retail market share relative to changes in incentive spending and transaction price to gauge whether OEMs are “buying” retail share through increased incentives, or whether share increases are largely demand-driven. An OEM with a positive RHI score is demonstrating a healthy balance of incentive spend relative to market share, either by holding incentive spending flat and increasing share or by increasing incentives with a higher positive increase in retail share.

Forecasts for the 13 largest manufacturers by volume: