How do you know which of your vehicles have open safety recalls right now?

New recalls come out almost every day. When vehicles are sitting on the lot, that would be the time to catch them. Not when you’re (manually) going through the paperwork at the time of sale and maybe checking for recalls. What if you need to order parts? “Come back next Thursday” can be a deal-killer.

If you know right away, you can get them repaired and never have to disclose anything, because the recall will have been remedied.

Dealers Are Not Catching All Recalls

Dealers tell me that they are worried that manual processes mean not all vehicles are being checked. They are right. It’s worse: By using only one source, you’re bound to miss recalls. Think of it this way:

Manual Process = Missed Recalls = Lost Revenue + Higher Liability

How much manual effort is required each month? Do you check your inventory with multiple sources every day to ensure you know what the safety recall status is? Do you think there might be a better way? To reduce costs and even make your life easier, have you considered automating this process?

What Dealers Say

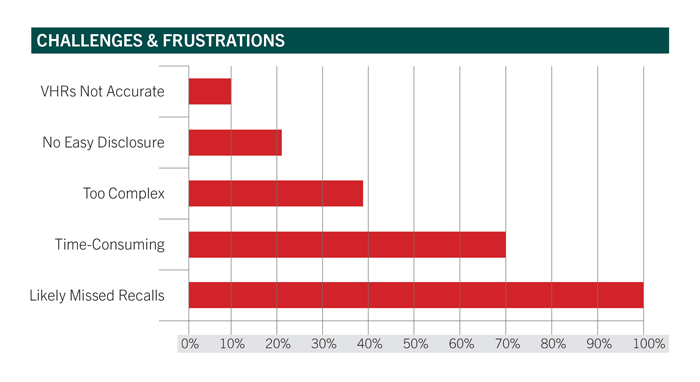

We surveyed clients recently. They shared their challenges and frustrations about managing recalls. In addition to it being time-consuming, they knew something was amiss. They were missing recalls. If you think you’re covered, you’re not!

Doesn’t SaferCar Cover Us?

Some prospective clients ask: “If we use a government site (SaferCar.gov) to check VINs, doesn’t that mean we’re OK?”

No. It does not. Anyone can sue anyone. If anyone is seriously injured or dies, you may hear these words from a judge: “You knew or should have known that these sources are flawed.” Google “NHTSA Data Errors.”

Most dealers are unaware of the flawed safety recall ecosystem. Our research shows a consistent 30% error rate in NHTSA’s database! Because you are not a “safety recall expert,” how can you know how flawed the ecosystem is?

7-Question Self-Assessment

To increase your revenue while decreasing liability, just answer seven questions. This will help you self-assess and learn which areas might need attention:

1. Do you have a written safety recall management policy? Y/N

2. If yes, have all employees signed it? Y/N

3. Do you review the policy with employees once per year? Y/N

4. Do you check every vehicle for recalls upon acquisition? In-brand, off-brand, new and used? Y/N

5. Do you check every vehicle for recalls upon sale? In-brand, off-brand, new and used? Y/N

6. Do you check every inventory vehicle for recalls every day? In-brand, off-brand, new and used? Y/N

7. Do you use multiple sources — even on your own brands? Y/N

If you answered “No” to any of the questions, you are probably missing recalls (= lost revenue and selling vehicles with open safety recalls).

What is Your Recall Liability Score?

What if there was a way to know your safety recall liability? Perhaps a “score” from 0 (lowest) to 100 (highest)? If you could access this at any time, from any web-enabled device, along with specific actions to take to reduce your liability, would you?

The more vehicles you sell with open safety recalls, the higher your liability and the lower your profitability.

The goal is to reduce your chances of selling (or not disclosing) recalled vehicles. However, if you don’t know a vehicle has a safety recall, you can’t disclose it. Relying on intermittent manual processes is not the answer. Checking just one source is not the answer. And, hoping is definitely not the answer.

9 Steps to More Revenue and Lower Liability

There are specific actions you can take to decrease your liability, increase customer safety and generate additional warranty revenue. We’ve discussed most of these in other AutoSuccess articles, and are providing a reminder:

1. Have a written safety recall policy.

2. Have a recall point person.

3. Automate your vehicle verification/monitoring system.

4. Print consumer disclosures with every vehicle retailed.

5. Ensure you know the Stop Sale status of every recall.

6. Activate an automated post-sale recall audit.

7. Manage recall status for every vehicle.

8. Verify both new and used inventory using multiple sources.

9. Know your Safety Recall Liability Score!

These actions can help you focus on your core competencies: selling, servicing and financing vehicles.