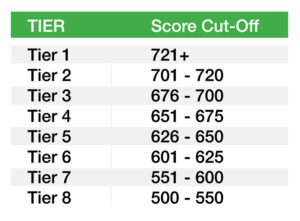

Did you know that the average difference between a typical lender credit tier is less than 30 points? More importantly, there is only a 96-point spread between a top credit tier (excellent credit) to a lower tier (credit challenged). This narrow spread demonstrates an opportunity for dealers to pull a second (or third) bureau to put their customer in a higher credit tier, therefore qualifying them for a much better interest rate and creating a great customer experience — not to mention providing the opportunity for dealers to make more reserve income on the loan.

The point spread between credit bureaus can range from five to 10 to well over 100 points. The average spread is between 40 to 50 points. So why do credit scores vary between bureaus?

• Not all lenders report to all major credit agencies

• Differences in reporting, maintaining data

• Varying dates of data reporting

• Incomplete reports or reporting errors

• Old vs. new data retention

Examples of Credit Spreads Between Bureaus

Above is an example of a typical lending table showing the score range and associated credit tier. We can use this as a reference for some real-life examples of the credit spreads that can exist between credit bureaus.

Example 1:

108-Point Spread — Tier 3 to Tier 1

The first example demonstrates a large 108-point spread between bureaus, with one bureau showing the lowest score, which puts the consumer into Tier 3 and another has the highest, which puts the consumer into the most favorable lending tier. In this example there is only a one-point difference between two of the bureaus. If the dealer only pulls the first bureau, they might lose the deal due to the higher interest rate offered because of the lending tier the consumer falls in to. But since they pull all three and have associations with lenders that accept all three — they have the opportunity to get the best rate possible for a Tier 1 customer.

Example 2:

51-Point Spread: Tier 3 to Tier 1

This second example is a more modest point spread of 51 points between the highest score (734) and (683) with the third falling right in the middle (707). Even a more modest 51-point spread will move the consumer from a Tier 3 to a Tier 1, getting the best interest rate available from the lender.

Example 3:

12-point Spread — First Score (710) is Tier 2, but Third Score (722) is Tier 1

Not all spreads are large; this example shows a very tight range of 12 points, but what is important is that if the dealer stopped at the first score of 710, the customer would have been put in Tier 2. But the dealer in this example pulls all three bureaus and the third score is 722, which bumps them up to Tier 1.

Work With Your Lenders

It is important to know which of your current lenders will look at more than their primary bureau and accept scores from alternative bureaus — especially if your client falls a few points short of the next best tier. Most will look at a secondary and some will look at all three, but only if asked by the dealer.

If dealers are having trouble getting their current lenders to look beyond their primary bureau score(s), you could potentially seek out relationships with other lenders willing to take a more aggressive approach to fund your deals.

Especially in the middle tiers, the number of lenders with programs for mid-tier credit is growing rapidly. Ensure you have lender relationships that cover all three credit bureaus.

Common Format Credit Reports

Most finance managers still use the credit reporting agencies’ report formats. These are unique to each bureau and can be very difficult to read. Make your life easier. Ask your credit provider if they have a standard report view that takes each bureau’s information and puts it in a common, readable format so that all information can be found in the same location no matter which bureau is utilized.

Benefits of Pulling Multiple Bureaus

There are many benefits to dealers when they adopt a strategy to pull multiple bureaus for each customer:

• You can offer your customers a lower interest rate, which will lower their monthly payments and make it more likely they will buy/fund the car through your store.

• You could increase gross profit on deals.

• You can fund exponentially more deals — those that you may have walked away from given the lower score provided by just one bureau pull.

• You can achieve increased customer appreciation and satisfaction — your customers will appreciate you working harder with lenders to get them the best interest rate possible.

What You Can Do Now

How many bureaus do dealers pull on average? Roughly 25 percent pull all three nearly every time they search for funding for their customers. Another 35 percent pull at least two bureaus. Are you one of the 40 percent who only pulls one bureau?

Having the right technology to provide your managers the ability to quickly and easily select the right bureau and tier, based on the highest score that lender will use, is critical for success. Ensuring you have a consistent procedure to pull all three bureaus at the right time in the sales process before desking the deal is critical to maximizing the benefits of the multi-bureau strategy.

Thorough and on-going training is key, especially if turnover is an issue at your store. Ensure there is a process for knowledge transfer of key lending practices, including strategies for multi-bureau pulls to fund the best deal for your customers.

And finally, senior management must continually show their commitment to the process by meeting with managers on a weekly and monthly basis, going over key reports that show the success of the multi-bureau strategy.

Click here to view more solutions from Ken Hill and 700Credit LLC.