The scale of the current coronavirus pandemic is overwhelming. As I write this, shelter in place orders still blanket our country, with 10 states taking tentative initial steps to reopen.[1] The health and safety of our families, co-workers, customers, nation and world is our priority. The pandemic that just eight weeks ago seemed far away as we socialized at NADA, is close at hand and personal.

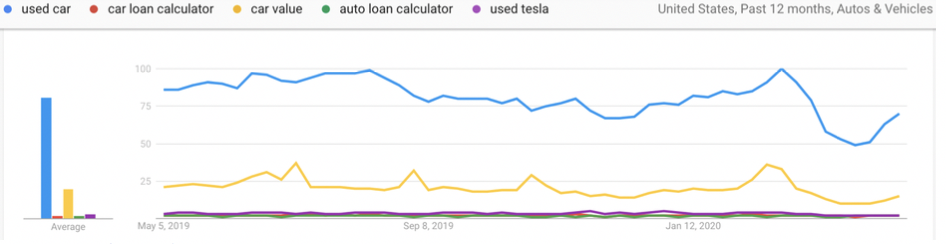

We saw the shift illustrated clearly in our interests online. Automotive web traffic grew 3.4% in 2019, according to SimilarWeb[2], and the top five non-brand keywords[3] that drove desktop traffic to the category continued to look strong through the beginning of 2020.

Source: Google Trends

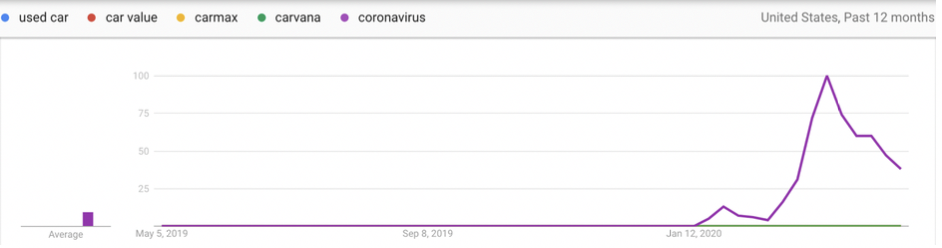

That is until the end of February, after we all had returned from NADA, closed out a solid financial month with that extra day in February and then it hit. You can see that interest in the chart above with the peak in the top terms of “used car” and “car value” week ending February 29, 2020, and then it begins to fall off. For scale, these two top terms, plus “CarMax” and “Carvana” all represent high search volume in the automotive category and they are a flat line when compared with the magnitude of “coronavirus” searches in the chart below, as our collective focus shifted fully to the coronavirus outbreak at home.

Source: Google Trends

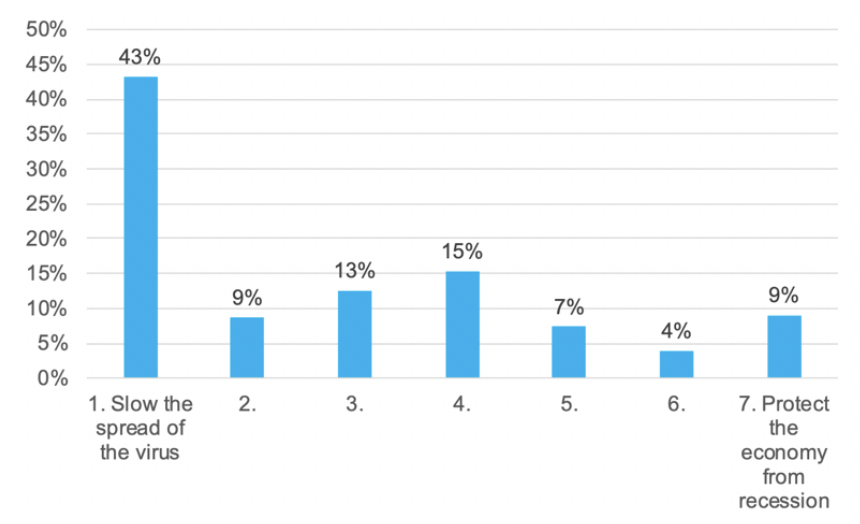

It would be great if we could do all the things required to bring this outbreak under control, while simultaneously digging in to fight the economic consequences, but those missions are at odds and we’re focused first on the outbreak. A recent survey by UserTesting underscored this fact with 43% of people indicating if they had to choose between Fighting Recession vs. Fighting the Virus, they would put near total focus on fighting the virus, compared to 9% that would like total focus on protecting the economy and 48% that wanted varying degrees of balance in the middle.[4]

Source: UserTesting

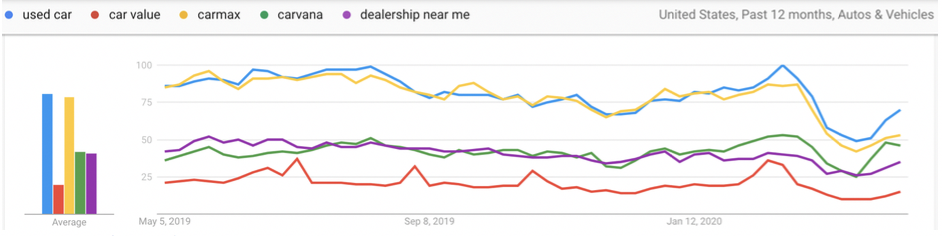

So, it was exciting to see something new in the traffic numbers below. As most dealerships are restricted in how they can sell cars and many of us are spending more time racking our brains for ways to progress the industry and our economy, there was a small change. Starting in week of April 5-11, 2020, we are starting to see an uptick in the searching for “carvana,” which is hopeful for the industry as that indicates an interest in car buying again and that maybe the “touchless” message is enough to get consumers comfortable to think about purchasing again. The term “carmax” also turned up and other top terms are not declining as quickly or are flat.

Source: Google Trends

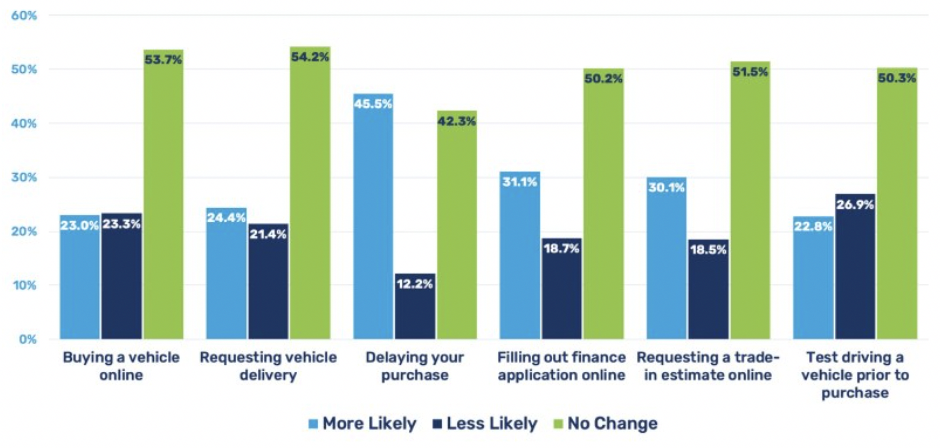

As the industry has struggled through the last four weeks after coronavirus was declared a pandemic, we expected that digital retailing would take off, but that hasn’t been the primary outcome we’ve seen. The primary outcome has simply been delay. That fits with the data we’ve seen in our most recent survey; 46% of respondents indicated that delaying a car purchase was likely the biggest change to their car buying habits due to the outbreak. Many moved from intent to purchase in under a year to either one to two years or over three years for expected purchase.

How have your plans on buying a vehicle been affected by the current coronavirus outbreak?

Source: MAX Digital Survey

Other key changes that shifted significantly included people being more likely to fill out a finance application and request a trade-in estimate online. Those two changes that support working out the details of the financial deal in advance of securing the vehicle were significantly more likely and would support an expedited process at the dealership. The behaviors that would suggest skipping the dealership entirely of buying a vehicle online, requesting vehicle delivery or test driving with were not significantly shifted by the outbreak.[5]

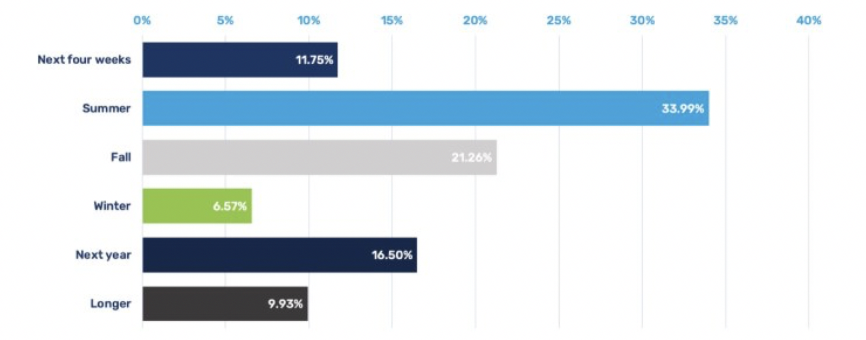

What does that all mean for your dealership? Well, the good news is, according to the University of Washington’s Institute for Health Metrics and Evaluation, the peak of this coronavirus outbreak is expected to have occurred on April 15, 2020, in the United States.[6] It will not likely be an immediate bounce back to vehicle purchases, but if peak concern is aligned with the peak of the pandemic, then we should also hit a bottom for automotive sales in April and see growth begin from that low point. There are lots of reasons to be optimistic for the automotive recovery over the summer. Your customers are starting to think about a return to normal and the largest number of them are expecting that return to occur in the summer.5

I think post coronavirus, things will be “back to normal” in the …

Source: MAX Digital Survey

That summer timing coincides with the July bounce back that is implied in the most recent NADA estimates for new car volume to hit between 13 million and 13.5 million.[7] That would indicate that some very smart economists agree with that projection as well.

It’s early, but when consumer focus returns to car buying, they will be more willing than ever to take the core actions to allow for expedited delivery of their vehicle. Digital retailing is going to help, but the flexibility of your staff in creating the safest experience for your employees and customers is the real key. Your team adopting a process that embraces helping the customer remotely as deep into the buying process as possible, seems to be more important than having the ability to “checkout” online.

It has been amazing to hear the range of stories from dealerships with creative accommodations, from allowing shoppers to be the only customer in the store to extensive cleaning and outdoor delivery scenarios fully outfitted for safety. The resilience and caring of the industry by your teams is on full display.

As the public focus shifts to the new normal, as we expect it will over the next few months, we aren’t going to feel as comfortable on public transportation or in ride-sharing situations as we did before. Automotive retail is a core economic engine for our country and the pieces are falling in place for it to be revving up again soon.

- New York Times, “See Which States Are Reopening and Which Are Still Shut Down”

- Liron Hakin Bobrov, Sarah Mehlman, SimilarWeb, March 2020, “Digital State of the US Automotive Industry”

- SimilarWeb, “Digital 100“

- UserTesting, “Consumer Impacts of Covid-19, The Stats and the Rest of the Story.”

- MAX Digital, “Coronavirus Impacts Study March 26, 2020“

- Institute for Health Metrics and Evaluation, “COVID-19 Projections“

- NADA, “NADA Issues First Quarter 2020 Analysis of Auto Sales“